Booking Profits and Identifying Opportunities

The combination of the Presidential Election process and the Coronavirus is creating a volatile mix for investment markets—with 1,000-point swings in the Dow Jones Industrial Average becoming a frequent occurrence. As you know, over the last year we built an out-sized position in gold to hedge your portfolios. This gold position did its job when markets pulled back. On Friday, we took advantage of this volatility by booking some profits and reducing our gold position to a more normal-sized position. By taking some profits, we now have additional cash to take advantage of the opportunities this volatility is presenting.

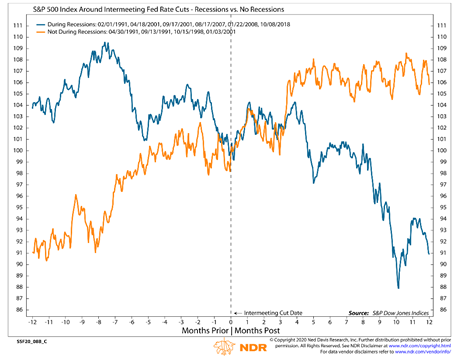

Yesterday, the Federal Reserve cut short-term interest rates by ½ of one percent (50 basis points) outside of their regular meeting process. As the orange line of the chart illustrates, after an intermeeting rate cut by the Federal Reserve the equity markets tend to rally for a few months assuming the U.S. economy avoids a recession. However, should the Coronavirus push the economy into a recession, then we could see another leg down (blue line) as the chart illustrates.

We are in a volatile period in the markets. The gold position served and will continue to serve as a safe haven during market volatility. With cash in your portfolios, you are well positioned to take advantage the opportunities this volatility provides.

As we noted in our 2020 Outlook: “Historically, we see a couple of pullbacks in the stock market during a presidential election year. We would expect this year to be no different. All in all, given the economic backdrop and strong long-term drivers supporting the economy any pull back in the stock markets should be viewed as an investment opportunity.”

* * *

From a financial planning perspective, the Federal Reserve’s rate cut yesterday is driving interest rates to their lowest levels in history. This has also provided an opportunity. Now may be a good time to consider refinancing your mortgage—whether to lower your monthly payment, shorten the length of your mortgage or pull equity out of your asset—rates have never been lower. As always, please do not hesitate to call us if you have any questions with regard to your financial life.

RIGGS INVESTMENT COMMITTEE

Robert J. Graham, Founder

Robert H. Graham, Chief Investment Officer

Elizabeth Graham

Alan Glassman

Susan Shoemaker

Robert J. Graham

The Riggs’ Report is written and published by Riggs Asset Management Company, Inc. The information contained in this Report is for informational purposes only and should not be construed as investment advice.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs Asset Management Company, Inc. (“Riggs”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure Brochure discussing our advisory services and fees is available upon request. Please Note: If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Riggs shall continue to rely on the accuracy of information that you have provided.