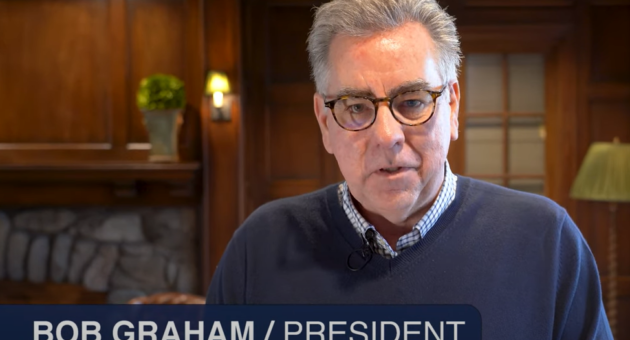

Bob Graham, President of Riggs Asset Management, discusses whether there is still gas in the tank for the stock market rally.

Happy Thanksgiving!

On behalf of the Riggs Team, we wish our U.S.-based clients and friends a safe and happy holiday.

Implications of this week’s softer inflation number

Implications of this week’s softer inflation number

Bob Graham and Susan Shoemaker discuss the implications of this week’s softer inflation number.

A Muddling Market to a Year-End Rally

A Muddling Market to a Year-End Rally

On an equal-weighted basis, the S&P 500 is negative year to date. Yet a handful of 7 or 8 stocks have driven the index higher on a cap-weighted basis. Is this reminiscent of the “Nifty Fifty” era of the 1970s where 50 stocks drove the stock market higher until their subsequent crash and underperformance through the early 1980s? Bob Graham and Liz Graham discuss and share their thoughts on portfolio …

Near The Bottom Of This Intra-Year Drawdown

Seeing Opportunities

It was another down day in the markets. Every year for the past 40+ years, the market has experienced an intra-year drawdown with an average drawdown of -13%. Since 1974, the S&P500 has risen an average of 8% one month after the bottom and an average of 24% one year later. Looking at the Fear vs. Greed Index, we are starting to see sentiment in the “Extreme Fear” range. So it is likely that most …

A Message from Riggs

A Message From Riggs

The attack on Israel by the terrorist group Hamas has been at the forefront of our thoughts and the news this week. Today our Founder, Robert J. Graham, sat down to share his thoughts and that of the Riggs Team.

Interest Rates – Higher For Longer

Interest Rates – Higher For Longer

The Federal Open Market Committee met last week. They kept short-term interest rates unchanged. However, the comments by Federal Reserve Chair Powell following the meeting told the investment markets that rates would stay higher for longer. In response, the market has pulled back a little. While higher for longer rates have been a short-term headwind, we are seeing long-term opportunities for savers and equity investors. Let’s dive in…