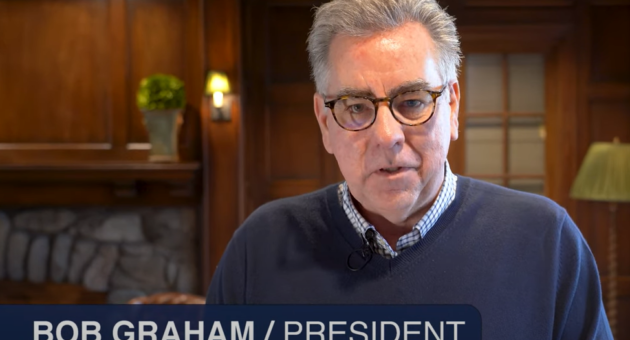

Bob Graham, President of Riggs Asset Management, discusses whether there is still gas in the tank for the stock market rally.

Inflation Higher and Stocks Rip

Inflation Higher and Stocks Rip

This morning, the February Consumer Price Index (CPI) reported an increase of +0.40%, a “hot” reading, compared to Wall Street’s +0.30% expectation. We believe that the higher than expected reading is driven largely by seasonality–resetting of new pricing on goods and services usually occurs in January. Once we get past this first quarter, we expect inflation to continue its downward trend. In his remarks last week, Federal Reserve Chairman Powell reiterated his commitment to cutting …

Will the Magnificent Seven Repeat?

Will the Magnificent Seven Repeat?

The unprecedented bull run of the largest companies in the S&P 500—commonly referred to as “The Magnificent Seven”—has led many investors to question whether we are on the brink of an adjustment. These juggernauts, consisting of Amazon, Microsoft, Nvidia, Apple, Google, Tesla, and Meta, significantly influenced market dynamics in 2023, powered largely by the explosion of artificial intelligence (AI) technologies.

The Magnificent Seven stocks account for nearly 1/3 of the market cap …

January, 2024 – Investment Market Recap

January, 2024 – Investment Market Recap

About half of the S&P 500 companies have now reported their quarterly earnings and those earnings reports have been fairly impressive, with a little more than 40% of those companies reporting earnings growth of 10% or more. This is the highest this percentage has been since 2022, and it suggests that the earnings recession may be over.

The International Monetary Fund (IMF) revised its 2024 global economic forecast upwards, including its …

Happy Thanksgiving!

On behalf of the Riggs Team, we wish our U.S.-based clients and friends a safe and happy holiday.

Implications of this week’s softer inflation number

Implications of this week’s softer inflation number

Bob Graham and Susan Shoemaker discuss the implications of this week’s softer inflation number.

Inflation Softens and Sparks a Rally

Inflation Softens and Sparks a Rally

As we’ve been noting for the last couple of weeks, some good economic data would likely ignite a year-end rally. This week, economic data showed a sharp slowing in inflation pressures, driving a sharp downturn in interest rates and signaling that the Federal Reserve may be done raising short-term rates. And in response, the S&P 500 turned higher by +2%. As we stated last week, a lot of cash is sitting …

A Muddling Market to a Year-End Rally

A Muddling Market to a Year-End Rally

On an equal-weighted basis, the S&P 500 is negative year to date. Yet a handful of 7 or 8 stocks have driven the index higher on a cap-weighted basis. Is this reminiscent of the “Nifty Fifty” era of the 1970s where 50 stocks drove the stock market higher until their subsequent crash and underperformance through the early 1980s? Bob Graham and Liz Graham discuss and share their thoughts on portfolio …