As the U.S. and the rest of the world woke up this morning, we witnessed a changing of the guard in Washington. This election was much like the Brexit vote, the pundits and prognosticators never saw it coming.

The last time we saw an election outcome like this was in 1948 when President Truman defeated Thomas Dewey.

While that will no doubt be the discussion for talking heads on TV, Facebook, and Twitter, our discussion today is what does this mean for the markets and your investment portfolios?

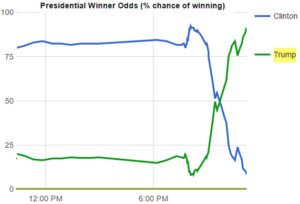

Source: electionbettingodds.com

In our October, 2016 Riggs’ Report, we discussed the upcoming Presidential Election and our conclusion at that time was that regardless of who was elected President, the U.S. economy would continue to move forward and the stock market would most likely move higher.

With the U.S. Presidential Election less than a week away, we have received several phone calls asking what happens to the stock market, if “Fill in the Name” is elected President. We thought we would share our thoughts on some of the likely outcomes.

It appears there are three likely outcomes (in no particular order):

- A Democratic President and a Republican Congress

- A Democratic President and a Split Congress

- A Republican President and a Republican Congress

In all three of those scenarios, the Dow Jones Industrial Average should continue higher (based on historical precedence as the table below shows).

|

DJIA Real Performance vs. Presidential (based on monthly data from 1901 to 2016) |

|

|

When U.S. Government has a:

|

% Gain/Annum |

| Democratic President, Republican Congress | 4.78% |

| Democratic President, Split Congress | 7.99% |

| Republican President, Republican Congress | +6.85% |

| Democratic President, Democratic Congress | 2.96% |

| Republican President, Split Congress | -6.05% |

| Republican President, Democratic Congress | -2.05% |

| Concept courtesy Ned Davis Research | |

Regardless of who won the White House, we felt there were areas of bipartisan support that would likely be accomplished in a new administration and that they would be positive drivers for the U.S. economy. Those areas include:

The U.S. Corporate Tax Code – Both Republicans and Democrats seem to be willing to address the U.S. corporate tax code. Currently, there are more than $2 Trillion sitting overseas that American Corporations are effectively blocked from bringing back to the U.S. due to our punitive tax code…Whether corporations spend it on research and development, plant and equipment, dividends to shareholders, or expanding jobs at home, there is only upside for the U.S. economy if this money can be repatriated back to the U.S. economy.

Infrastructure – There seems to be bipartisan agreement to move towards rebuilding our infrastructure. Infrastructure projects tend to be long-lived multiyear undertakings and a thoughtful approach to this issue could provide the underpinnings for sustained economic growth. This could serve as a boon to the U.S. economy and jobs.

Historically, Republican Presidents are fiscally conservative and work hard in their first two years in office to reduce fiscal spending. Donald Trump is not a typical Republican. His primary economic focus during the campaign was “jobs, jobs, jobs.” Therefore, the infrastructure-spending package he promotes could be much bigger than expected.

Now that we know what both the administration and the legislative branches will look like we can add a couple of other items that could impact U.S. economic growth.

Regulation – Regulation is necessary for a well-functioning economy. However, too much regulation can cripple small businesses and stifle entrepreneurship. Corporations have been reticent to spend and re-invest capital. That was due, in part, to an uncertain regulatory environment. The expansion in regulations in recent years has had a chilling effect on economic growth. It is important to remember that the majority of all jobs created in the United States are created in businesses with less than 50 employees. While large corporations can afford to hire throngs of attorneys to manage through the regulatory environment, small business do not have that luxury. A more thoughtful approach to regulations could be a blessing to small businesses and entrepreneurship and, in turn, aid U.S. economic growth.

Health Care – If the current median household income in the United States is just over $57,000, which means that half of American households earn less than $57,000. A health care insurance system that consumes 20% of after tax income before it kicks in can be devastating to families. The old health care system was broken and the new system is collapsing. A bipartisan approach to address the rising cost of health care coverage should help American families and Small Businesses.

As you know, we have positioned your portfolios in Financials, Industrials, Energy, Materials and Health Care. These sectors are well-positioned for growth and expansion given the policies outlined by the new Administration and the support of a Republican Congress. That does not mean that we see only smooth sailing ahead. Even though the Republicans will control the White House and both Chambers of Congress, the legislative process is much like “herding cats”–everyone has their own opinions and has to answer to their constituents. As we have seen, Donald Trump is not a typical Republican. To accomplish his agenda will require 60 votes in the Senate. With only 52 Republican Senators, there will need to be bipartisan support by both Republicans and Democrats in order to achieve his goals.

Outside of the election, the one concern that continues to bother us is the stretched valuations of the U.S. Equity markets. Much of this overvaluation has been driven by the exhaustive search for yield as the low interest rate policy of the Federal Reserve has driven fixed income investors into riskier investments such as high dividend paying stocks. This search for yield phenomena has driven prices of historically “conservative” equity sectors, such as Utilities, Real Estate, and Consumer Staples, to extremely overvalued levels. While more cyclical sectors, such as Financials, Industrials, Energy, Materials and specific areas in Health Care are undervalued. Therefore, in a way, it has become a bifurcated market when it comes to valuation—where historically “conservative” areas are overvalued and represent higher than normal risk and historically “cyclical” areas are undervalued and represent lower than normal risk.

We will need to keep a watchful eye on any policy or economic changes (i.e., rising interest rates) that could cause investors to return to the fixed income market. An investor group movement such as that could have an outsized effect on an overvalued equity market. However, if the Republicans are successful in reigniting economic growth that should help to normalize valuation levels.

All in all, the politicians on both sides of the aisle have provided rhetoric that has mitigated this election surprise. It will now depend on those same politicians to turn that rhetoric into action and provide a positive bump to U.S. economic growth. If they are successful in doing that, the investment markets should respond in kind.