Changing Things Up

At Riggs, we have always prided ourselves on our risk management, contrarian approach. In June, 2016 when the entire world expected Brexit to be voted down, we put gold in your portfolios as a contrarian investment to offset market volatility should Brexit pass. Brexit passed and gold popped. We did something similar in November of that year for the U.S. Presidential election. It is that willingness to view the markets from a risk-management perspective that has allowed our firm to grow and thrive over the nearly 30 years of its existence.

Internally, we try to do the same thing. We occasionally step back and look at every aspect of our business and our process and see if we can do it better. Our most recent focus was the Riggs Quarterly Statements. We looked at the statements and asked the question “if I were a client reviewing this statement, would I understand the investment strategy in place?” The answer we came up with was “no” so we changed our Statements. We thought we would use this Riggs’ Report to outline the changes we made and how it relates to our Investment Strategy.

First, let’s look at the Portfolio Overview page. This page is intended to provide you with a quick snapshot of the Portfolio, how it is invested and how those investments are performing. There are four sections in the Portfolio Overview page as follows:

Asset Allocation Section: The Asset Allocation Section contains a pie chart and breakout of the holdings by dollar amount and percentage of investment. We have adjusted the category names to our key investment themes. This way when we add a name to your investments, you will know where that company fits—is it an investment in 5G build out or demographics, etc. Further, you will see the percentage allocated to that area. For example, do we see more opportunity in Growth or Income?

Portfolio Value vs. Cumulative Net Investment Section: This chart we internally refer to as the Mountain Chart. The gray line represents the net amount of money you have invested (deposited/withdrawn) from your portfolio. The green part of the chart is the investment gain you have realized. When you are younger and in saving mode, you should see the gray line stair step higher. When you are retired and in spending mode, you will see the gray line stair step lower. Our goal is always to keep the green higher than the gray line.

Components of Change Section: This section shows by dollar amount, what you started with, your net deposits/withdrawals since inception and year to date, the ending value of the portfolio as of the date of the report, and then highlighted in gray the investment gain or loss in the portfolio.

Portfolio Returns Section: This section shows the percentage of gains or losses from Inception and Year to Date. All of our returns are reported net of fees.

The next section is Portfolio Holdings. The two key things to note on this section is that the Portfolio Total (including Annual Income) is on the first line of the report in a navy blue block. The other item to note is that the holdings are now broken out first by Investment Theme, then by Sector, and finally by individual company or investment. Again this is to allow you to understand where a company or investment fits within the Investment Strategy. The final report is the Billing Statement showing the calculation of our fee.

Now that you can see the breakout of Investment Themes in your portfolio let’s discuss some of those themes in more detail.

* * *

From an economic standpoint, the global economy and specifically Europe is teetering on the brink of recession. The U.S. economy, even with slowing growth, stands as a bright spot in the World at least for now. It remains to be seen if trade and economic policy uncertainty from Washington or a potential global recession would chill the slowly growing U.S. economy but, for now, the U.S. economy remains resilient.

With this as the backdrop, you would not be surprised to see: 1) some allocation to Growth since in a market with no or slow growth as a backdrop, companies achieving growth will be rewarded; 2) some allocation to income yielding companies since in a market with unpredictable economic policies and low yielding Treasuries, investors will be forced to get their income from stable, dividend-yielding companies; 3) Gold as both a hedge against market uncertainty as well as a store of value and safety for international investors and Central Banks around the World who seek a stable investment outside of the U.S. Treasury; and 4) Higher cash positions in a market environment with elevated economic risk.

Now let’s dive a little deeper into a few of those investment themes.

Expansion of Gold

As you know, we have also been increasing our position in Gold in your portfolios and on your statements we are now breaking that position out separately from both bonds and stocks. Your statements reflect four major categories now—1) Fixed Income; 2) Equities; 3) Gold; and 4) Money Market/Cash.

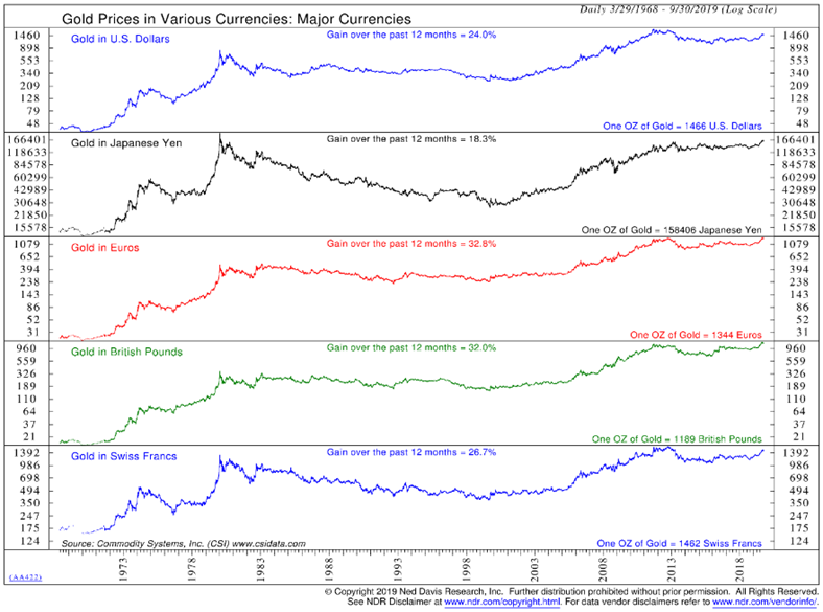

Gold is a unique investment. It represents a store of value outside of one’s currency and as such Gold’s moves tend to be global in nature. Currently, Gold is moving higher against all major currencies across the globe, as illustrated by the chart.

Since Gold represents a store of value, it tends to do well during periods of inflation and deflation as well as periods of heightened volatility. Recently, we have seen the global demand for Gold increase driven by global Central Banks. While Gold is a store of value outside of currencies, it is priced in U.S. Dollars just like oil. Thus, purchasing Gold allows foreign Central Banks to buy a Dollar-denominated asset other than U.S. Treasuries. According to the World Gold Council, foreign Central Banks have purchased 347 tons of gold in the first half of 2019, a new record high.

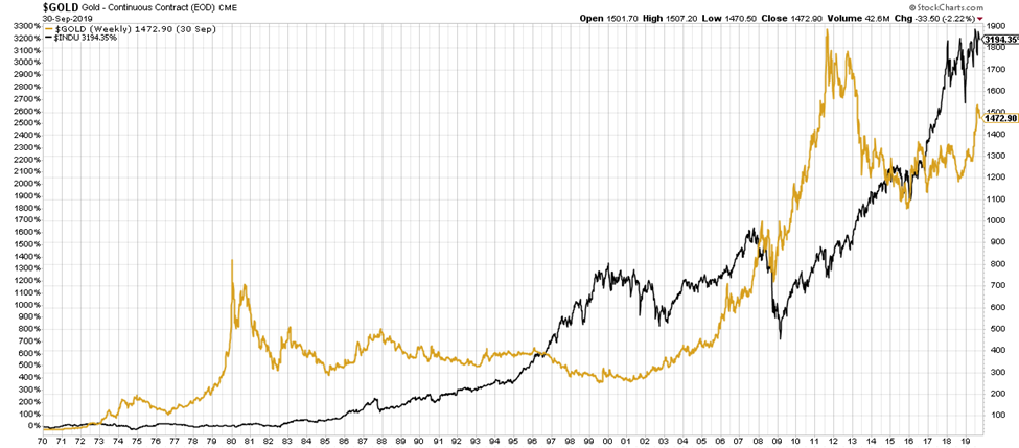

Since the U.S. came off the Gold Standard, Gold has gone through long periods of outperformance and underperformance vs. the U.S. stock market. You can see that during the 1970’s, the 1980’s, and the early 1990’s Gold outperformed. As the dot com growth began in the mid-1990s, stocks began to outperform.

It appears that economic policies and conditions are shaping up to provide a tailwind to Gold and we may be seeing a rotation to Gold outperforming stocks again. As global trading systems are in flux and will likely remain so for an extended period of time, and with more than $17 Trillion in debt now with a negative yield driven by global Central Bank policies impoverishing pensioners and savers, and with the two largest economies in the world—the U.S. and China–in what looks like a long-term technology war, Gold may be the best source of stability for investors. As a result, we have expanded our position in this area. While the size of the position may fluctuate in the portfolio based on economic conditions, it is likely to have a presence in your portfolio for some time to come.

The U.S. Demographic Advantage

The World is getting older. Countries like Japan and China are faced with a demographic challenge as their aging population dwarfs their young population. But the U.S. is in a different position. The U.S. is benefitting from two primary demographic trends: 1) an aging Baby Boomer population; and 2) the emergence of the Millennial generation.

Baby Boomers were the largest demographic group through the 1980’s and 1990’s driving a tremendous amount of economic expansion through those decades. Today, Baby Boomers will be the longest living demographic cohort in history. However, the good news for the United States is that Millennials represent the largest demographic cohort in our population. They provide a balance to the aging Baby Boomer population. Millennials represent roughly 27% of the U.S. population. They are, as a group, well educated and hardworking and are now coming into their own. Millennials are starting careers, building businesses and creating families—basically doing what every generation before them did. Millennials represent a unique tailwind for the U.S. economy. It is worth noting that while aging demographics is a global phenomenon, Millennials is largely a U.S. phenomenon/benefit. No other major developed economy has a large young emergent demographic cohort like the United States. This is a huge advantage for the U.S. economy.

Baby Boomers and Millennials combined represent roughly 50% of the United States population and as such will drive economic growth going forward. For example, both Baby Boomers and Millennials will increasingly consume health care—either from an aging perspective or family expansion perspective. As you can see from your statements, we have a significant allocation to health care.

The Build Out and Expansion of Cloud Computing and 5G

The build out of 5G will be the largest coordinated global infrastructure project ever seen. It will affect every corner of the globe from old world to new world, every country, province and community will be affected by this build out. The conflict between China and the U.S. is largely about who controls these new emerging technologies and 5G will be the connective tissue that allows these emerging technologies to communicate and interact with each other.

As the build out of 5G progresses, the Internet of Things (IOT) will expand exponentially. Machines will talk with machines and drive massive growth in data requiring faster and smarter computing. As this process evolves, it will require changes in the cloud computing infrastructure bringing more computing closer to individual interfaces.

The growth in 5G & Cloud Computing will have a dramatic effect on the way we live our lives and the way business and economies operate. For example, it will change:

- The way logistics and distribution systems function;

- How and where manufacturing is performed;

- How and where health care is consumed;

- The design and management of hospitals and surgical suites;

- The way we consume entertainment; and

- The way we work.

The Build out of 5G will take time and the build out of systems that function efficiently in this new high speed IOT data-dependent environment will also take time. This is a multi-decade opportunity that will create huge winners just as the internet and LTE/4G has over the past 30 years. You can see on your statements, that we have invested in companies involved in the build out of the infrastructure as well as companies that benefit from the increase in speed 5G will create. For example, we have started to build a position in gaming technology—that position will benefit from the enhancement that 5G will provide as well as the change in entertainment consumption driven by Millennials.

* * *

While this is just a quick snapshot of some of our Investment Themes, we hope you will find this new report structure to be useful in understanding where we are seeing opportunity and how we are investing. In future Reports, we will dive even deeper into some of the companies you have invested in and the opportunities for that investment. You will also be able to get a sense of whether we think there is greater or lesser risk in the market based on how the percentages in different Investment Themes expand and contract. We welcome your feedback as you review your Quarterly Statements. As always, please do not hesitate to contact us should you have any questions with regard to your financial needs and the Riggs’ Investment Strategy.

The Riggs’ Report is written and published by Riggs Asset Management Company, Inc. The information contained in this Report is for informational purposes only and should not be construed as investment advice.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs Asset Management Company, Inc. (“Riggs”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure Brochure discussing our advisory services and fees is available upon request. Please Note: If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Riggs shall continue to rely on the accuracy of information that you have provided.