Gold Is Doing Its Job

As you know, we have a significant position in gold in your portfolios. We did this as a counterbalance to market volatility. Gold serves as a store of value and a safe haven to investors during periods of volatility. With concerns of the Coronavirus increasing, investors are stampeding to safe haven assets causing gold to hit multi year highs.

We purchased gold as a hedge to global issues and it is working.

On a day like today with markets pulling back over concerns of the spread of Coronavirus, it is worth putting what is happening into some perspective. According to the U.S. Centers for Disease for the 2019 -2020 flu season more than 26 million people in the U.S. have fallen ill with flu-like symptoms, 250,000 have been hospitalized and at least 14,000 have died.

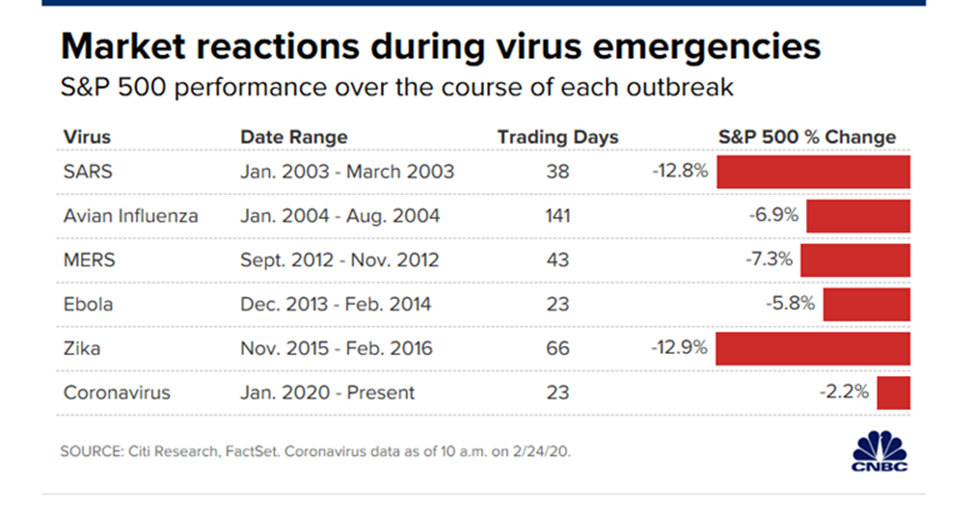

This is not to make light of the Coronavirus and risks of a pandemic is a concern and should be taken very seriously. This chart puts into perspective the investment market impact to date of Coronavirus in comparison to historical pandemics. Typically, investment markets recover relatively quickly once the spread of the virus is contained.

It is likely that Coronavirus will delay the economic recovery in Europe and China and that will cause a slowdown in the U.S. economy. We view this slowdown as temporary and the economic recoveries in Europe and China should resume when the spread of the virus wanes.

As we discussed in our 2020 Outlook:

…while the economic backdrop is solid, there are some issues (aside from politics) that could cause increased volatility in the markets this year…Equity markets in the U.S. are expensive. …Further, markets have become extremely concentrated with the top five companies representing more than 18% of the S&P 500…the combination of extended valuation and concentration into a few names rather than broad market participation make the markets vulnerable to increased volatility.

Even if we see increased volatility, with employment high, the Federal Reserve very accommodative and global trade improving, any pullback in the market is unlikely to affect the economy. Historically, we see a couple of pullbacks in the stock market during a presidential election year. We would expect this year to be no different. All in all, given the economic backdrop and strong long-term drivers supporting the economy any pull back in the stock markets should be viewed as an investment opportunity.

Clearly, we are seeing increased volatility and the gold hedge in your portfolios is doing its job. If you have any questions, please do not hesitate to contact us. In the meantime, we will work hard to manage the current market volatility and look for the opportunities it will provide.

The Riggs’ Report is written and published by Riggs Asset Management Company, Inc. The information contained in this Report is for informational purposes only and should not be construed as investment advice.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs Asset Management Company, Inc. (“Riggs”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure Brochure discussing our advisory services and fees is available upon request. Please Note: If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Riggs shall continue to rely on the accuracy of information that you have provided.