May You Live In Interesting Times

“I think that you will all agree that we are living in most interesting times. (Hear, hear.) I never remember myself a time in which our history was so full, in which day by day brought us new objects of interest, and, let me say also, new objects for anxiety. (Hear, hear).” – Excerpt from a Speech by British Statesman Joseph Chamberlain, 1898

While the quote “May You Live in Interesting Times” is sometimes credited to Joseph Chamberlain and sometimes credited to a traditional Chinese Curse, it certainly applies to the Year 2020 and we still have a few things ahead of us that should prove interesting!

As summer winds down and the U.S. begins to focus on the upcoming Presidential election, it would not surprise us to see market volatility re-emerge after a fairly quiet period. Surprisingly, while 70% of the U.S. market pullbacks in history experience a retest, we have not seen a retest of the March, 2020 lows. This is most likely a result of the extraordinary monetary and fiscal efforts of the U.S. Federal Reserve and Congress to provide a floor of support.

The Economy and the Safety Net

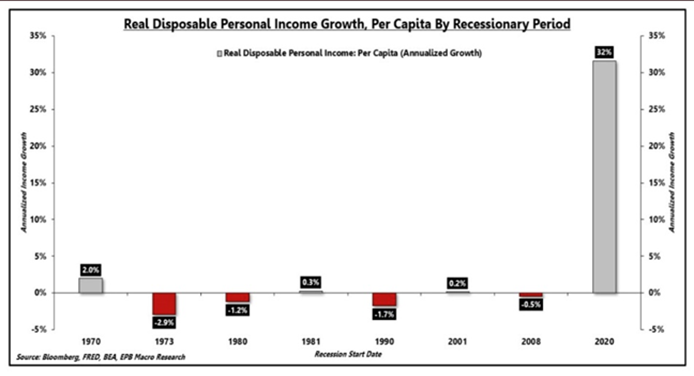

To put this in perspective, we have seen a huge increase in personal income driven by transfer payments from the Federal Government. The combination of enhanced unemployment benefits, direct payments through stimulus checks and the Payroll Protection Program to help businesses maintain employment levels have provided strong support to consumer income and spending.

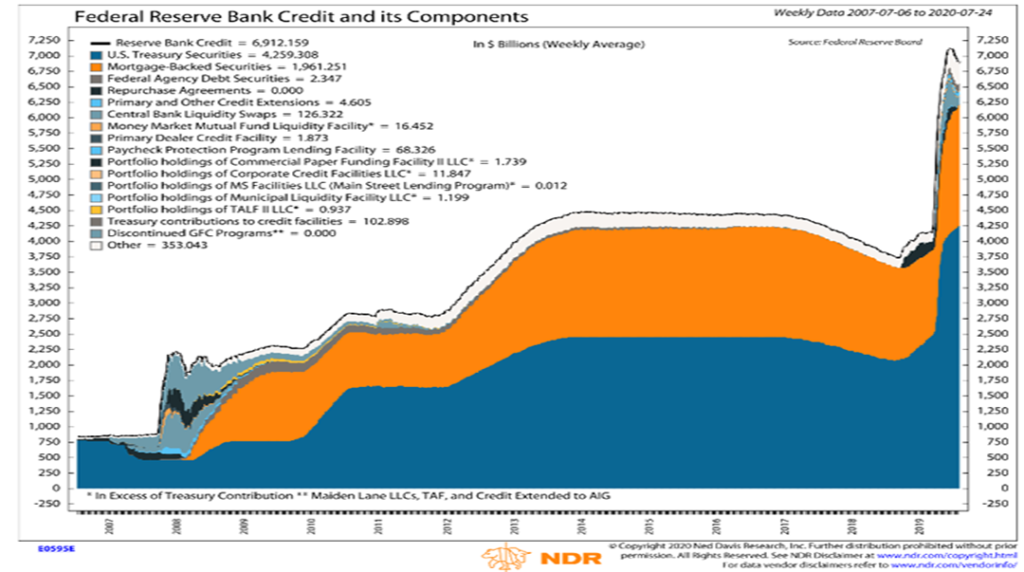

On top of this the Federal Reserve has pumped massive amounts of liquidity into the U.S. economy by buying up trillions of Dollars of bonds, such as; Treasuries, Mortgage-Backed Securities, Federal Agency Debt, Municipal (State Government) Debt, Commercial Paper, Investment Grade Corporate Debt and even High Yield (Junk) bonds. In essence, any segment of the U.S. Fixed-Income markets that could possibly come under pressure the Federal Reserve stepped in to provide support.

Further, the Federal Reserve cut short-term rates to near zero and promised to keep them there for an extended period of time perhaps into 2023. This is providing a window for both consumers and business to refinance debt and hopefully improve their balance sheets. These actions by the Federal Reserve are unprecedented both in magnitude and in the speed with which they occurred.

Combining direct transfer payments from the Federal Government to consumers with the extraordinary actions by the Federal Reserve has likely placed a base under the U.S. economy as we continue to deal with the COVID-19 pandemic.

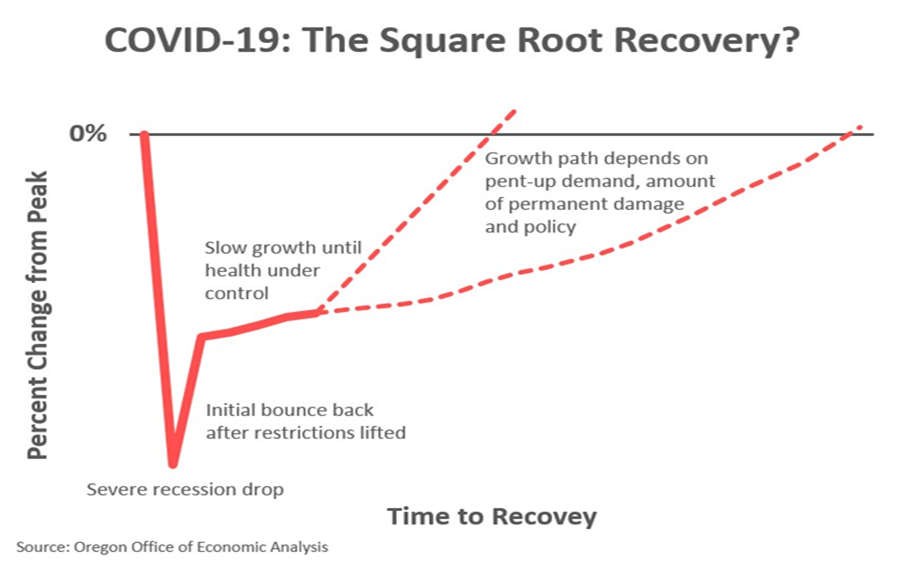

As a result, we have seen a relatively sharp initial recovery in the U.S. economy. Going forward, it is likely that we will see the recovery slow.

The CEO of Mastercard, Ajaypal Singh Banga, described it well in Mastercard’s most recent earnings report:

…the recovery will occur in four phases: Containment, Stabilization, Normalization and Growth. In the prior quarter, we commented that we believed we were in the “stabilization” phase – what comes once necessary mitigation phases are in place and the decline in spending levels flattens out as buyers look to purchase necessities and shift toward online shopping activities.

Today, we believe most markets to be in the “normalization” phase of the recovery – characterized by the gradual relaxation of mitigation efforts, throughout the rest of the year. We expect that progressing through the normalization phase and ultimately move to the growth phase, essentially, bringing us back to pre-Covid days is very much dependent upon turning the tide on infection, which you’ve seen in Europe, in Asia and the United States Northeast, but also is ultimately tied to the broad availability of a vaccine and proven therapeutics.

At the end of the day, it’s all about the progress made against the virus. While corporate management teams are doing their best to provide as much as they can on current and future operating conditions, the bottom line is that uncertainty remains high and the situation remains highly fluid. Our expectation is that the U.S. economy will continue to move forward in a stutter step fashion as we deal with the pandemic and supply change issues caused by the global shut down.

While it is likely we will see additional programs come out of Washington to help boost incomes and consumption and the Federal Reserve will continue to provide support and liquidity to the economy, the effect of these programs on the economy will gradually diminish. We are likely entering a slow recovery phase for the economy. Further, even after the pandemic is behind us it will take some time before the all the lost jobs are back and U.S. economy is once again running on all cylinders.

On Fixed-Income, We’ll Follow the Fed

With the exception of the U.S. Treasury market, the U.S. bond market saw the sharpest selloffs in history this year followed by the fastest recovery in history—the entire process took 32 days. Currently bond prices across all categories are at or near their highest prices ever while bond yields are at or near their lowest levels ever. The rally in the U.S. bond market is driven entirely by the actions of Federal Reserve. Our approach for fixed income investors is to continue to align ourselves with the Federal Reserve and buy what the Federal Reserve is buying. As long as the Federal Reserve aggressively supports the bond market, current pricing should hold. Once the economy recovers, it is likely that the Federal Reserve will stabilize its bond purchases and allow markets to gradually normalize.

While we invest in some Municipal Bonds for those in the top tax bracket, a note of caution is worth considering: While transfer payments have helped to boost incomes and support consumption, they have traditionally been non-taxable. Therefore, many state and local governments that rely on earned income taxes to support their budgets may come under significant pressure, especially those with high legacy costs and diminishing tax base. Municipal bond buyers should stick with the best credits.

Technology Driving U.S. Equities

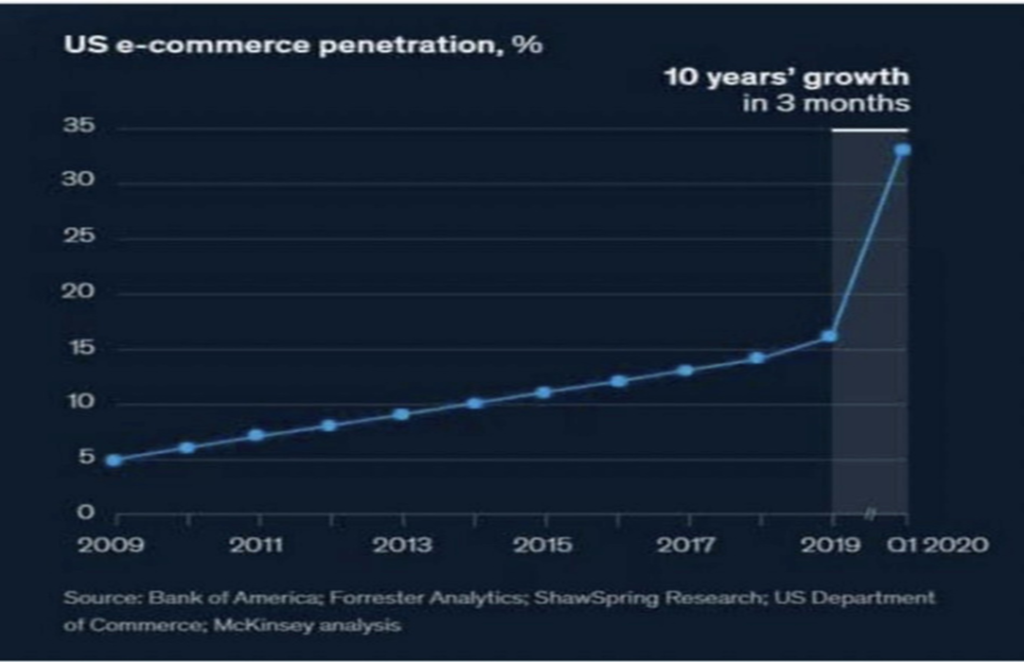

Similar to the Fixed-Income market, we have seen the fastest bear market/bull recovery in the stock market history. However, unlike the bond market there have been clear winners and losers. For example, consumer technology companies have been on a snorting bull-run as well as healthcare and home improvement companies while energy, financials and industrials remain under pressure. This makes sense, since most who could, have been working from home and have had to refit and upgrade their home technology. Not to mention the increase in online shopping and the home delivery of virtually everything. The Pandemic has essentially pushed e-commerce shopping trends forward by 10 years.

We are now entering phase two of the home upgrade, as “work-from-home” combines with “learn-from-home.” According to the National Retail Federation, U.S. consumers plan to spend a record amount on back-to-school preparations “Total spending for K-12 and college combined is projected to reach $101.6 billion – exceeding last year’s $80.7 billion and topping the $100 billion mark for the first time.” Top purchases include laptops, speakers/headphones and other electronic accessories.

This increase in work-from-home and learn-from-home will continue to drive the expansion in cloud computing and drive the demand for connectivity improvements such as 5G. These are not new trends but just like e-commerce, the pandemic has accelerated this trend.

We are concerned about equity valuations and concentration in a handful of names. As we wrote in the January Riggs Report: “Equity markets in the U.S. are expensive. Whether one looks at the price relative to book value, sales, forward or median earnings—valuations are stretched. Further, markets have become extremely concentrated with the top five companies representing more than 18% of the S&P 500. This is the highest concentration in history, surpassing even the Dot.com/ Y2K bubble of 1999.” (Emphasis added).

Fast forward to today and those same five companies now represent 22% of the S&P 500 and their valuations have only risen. To a large extent, this makes sense as these companies are prime beneficiaries of the work-from-home and learn-from-home trend. While we own all these companies in various forms either directly or indirectly, long-term this level of concentration is not healthy.

In a perfect world, we would like to see the economy grind higher with economic growth broadening to the other 495 companies in the S&P 500. This would be a healthy development.

However, we do not live in a perfect world and our expectation is as we approach the fall and the U.S. Presidential Election, we could see an increase in volatility and election angst. We are on alert to any increase in risk.

U.S. Stock Markets and Presidential Election Years

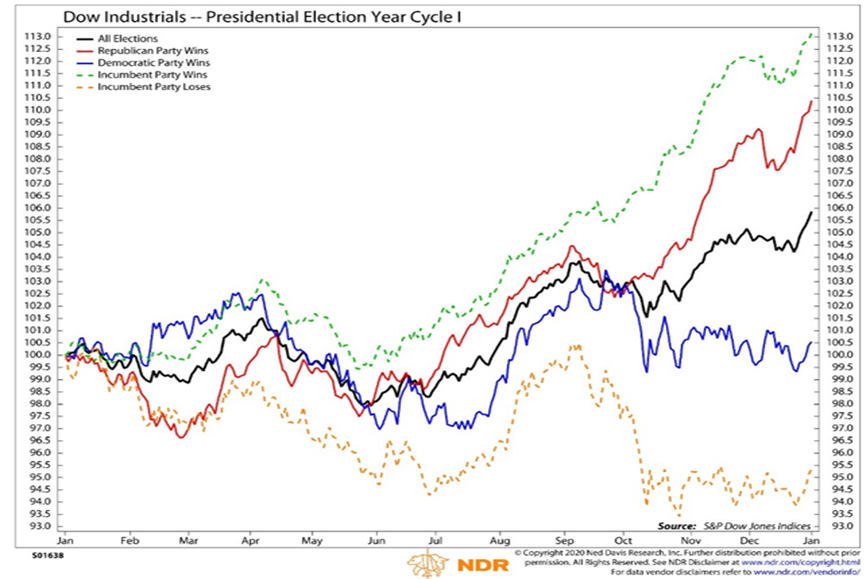

When reviewing the investment markets during a Presidential Election year, history can give us some insights into what kind of pattern investment markets may follow. In general, the year will start off solid and then the market will typically pull back heading toward primary season as political rhetoric escalates. The market usually recovers during the summer and then gets choppy closer to the election. While this year was unusual given the pandemic and economic shutdown, the election year historical pattern has largely played out so far this year.

The stock market tends to struggle in the second half of election years when the incumbent party has lost. The market hates uncertainty, and a new President brings unknowns. A tightly contested election could mean that election uncertainty (and volatility) could linger into the second half.

There are several reasons behind this historical pattern. Most incumbent candidates understand that if they have a good economy when they run for re-election their chances of winning are substantially greater than if the economy is weak. This holds true for both Presidential and Congressional incumbents. Therefore, most Presidential Administrations and Congressmen/women (regardless of party affiliation) work very hard to have a good economy leading up to their personal re-elections. As a result, we typically see a great deal of economic stimuli such as tax cuts and increased government spending in the year just prior to an election. In anticipation of the improved economic condition, the markets move higher.

As the election year progresses and the uncertainty of the outcome of the election develops, that uncertainty will be reflected in the markets and the markets will become more volatile. As of now, volatility is benign but we would not be surprised if we began to see it tick higher.

*********

As the World gyrates around us, we remain focused on executing on our strategy of managing risk in a volatile year. We did this in March by reducing holdings vulnerable to the hospitality and tourism industries, increasing our bond allocation and matching areas likely to receive Federal Reserve support, increasing our exposure to companies with strong balance sheets particularly in the technology and healthcare space, and maintaining a core position in gold. In combination, these moves stabilized your portfolios and allowed for their full recovery. Should volatility increase as we move closer to the election, we will once again put the defense on the field until there is more certainty on the election outcome.

For 2020 there are plenty of issues to go around and no doubt as the election nears, we will see the level of rhetoric reach extremes. However, election dynamics aside, the long-term forces driving the U.S. Economy remain in place. Healthy demographic trends and a strong consumer along with technology innovation will drive growth in the U.S. Economy. Our outlook is very positive based on these forces.

The Riggs’ Report is written and published by Riggs Asset Management Company, Inc. The information contained in this Report is for informational purposes only and should not be construed as investment advice.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs Asset Management Company, Inc. (“Riggs”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure Brochure discussing our advisory services and fees is available upon request. Please Note: If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Riggs shall continue to rely on the accuracy of information that you have provided.