Navigating the Coronavirus Recession

The last several weeks have been difficult for America and countries across the Globe. Quarantines, business closures, and social distancing measures have shutdown economies worldwide. This has expanded concerns from the health threat of the virus and loaded economic concerns on top. As a result of the measures taken, the United States and the Global economy have plunged into a recession and the U.S. stock market has seen the sharpest and quickest decline in its history.

Fortunately, the actions we took early from raising cash to keeping on a gold hedge has added stability to your portfolios during this difficult period.

Just as doctors and scientists are working on vaccines and remedies to cure the Coronavirus, governments and Central Banks are implementing their own medicine. As they did during the great Financial Crisis of 2008, The Federal Reserve has embarked on a massive quantitative easing program buying hundreds of billions of dollars of Treasury bonds and mortgage backed securities. This time they are taking it even further by purchasing municipal bonds, corporate bonds and commercial paper; not to mention backing loans through the Treasury and SBA for small businesses. The depth and breadth of the Federal Reserve’s activities to support the economy are extraordinary. If you believed that similar actions taken during the last financial crisis amounted to firing a bazooka to support the economy, then they are bringing howitzers to this fight.

Small businesses and everyday citizens are set to receive a little fiscal relief as well–loans and grants for businesses and $1,200 stimulus checks for individuals. The latest package out of Washington will be a productive first step towards economic stability, however, it is not enough to offset poor demand or lost employment. Therefore, it is likely we will see additional efforts by the government to jump start the economy.

While we navigate through this process, it is important to understand how this process will likely unfold and what opportunities lay ahead. From there, we lay out our game plan.

The Bottoming Process

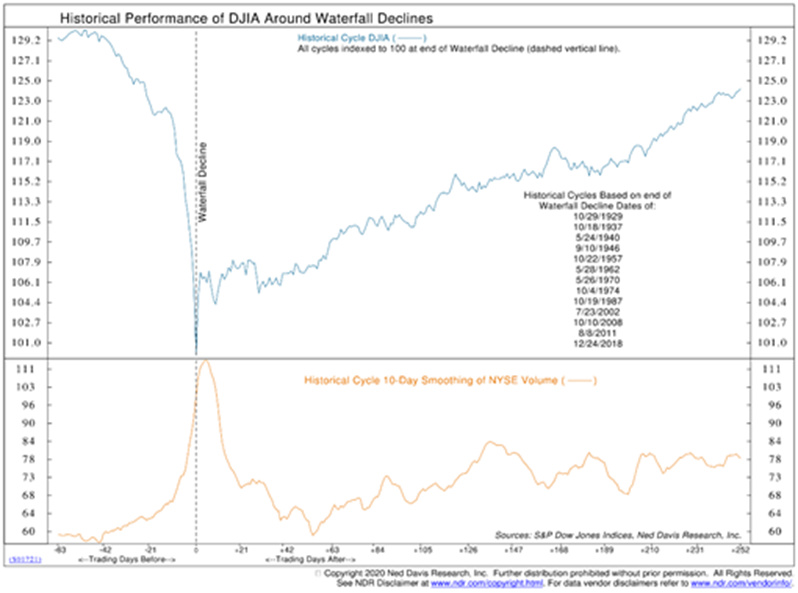

The March 23rd stock market low marked the beginning of the bottoming process for U.S. equity markets. Historically after a waterfall decline the markets go through a bottoming process consisting of a rally followed by one or more retests of the initial low often breaking below the initial low. From there a breadth thrust–rapid, increased activity on the buy side–indicates the beginning of a new bull market.

- Initial bottom where markets become oversold

- A Rally off that bottom

- A Retest(s) of the initial bottom

- A Breadth Thrust that indicates the beginning of a new bull market

The chart below is a composite of all thirteen waterfall declines since 1929.

In nine out of thirteen cases after a rally the Dow Jones Industrial Average has broken below the initial waterfall decline lows. In three out of four cases when the waterfall lows were not breached, the DJIA still retested. The one exception was in 2018 where we saw a V shaped recovery.

We anticipate at least one retest of the March 23rd lows–likely breaking below it–before a new uptrend can be established.

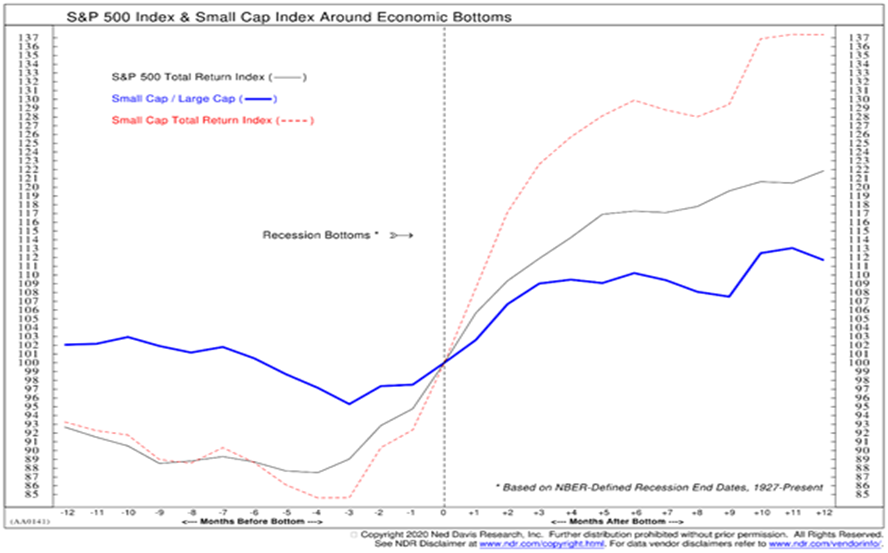

Markets Bottom before Recessions

Historically, the stock market tends to bottom before a recession bottoms. The U.S. economy has been shut down for several weeks now and is no doubt in a recession. The current expectation is that the economy will remain shut down until at least the end of April. For the economy, things will get worse before they get better. The stock market on the other hand, may recover before the recession ends.

The chart below is a composite of the bottoming process after waterfall declines since 1938. It shows that markets tend to bottom roughly three months before the worst of a recession is upon us.

The Coronavirus is the quintessential exogenous event affecting people, companies and countries across the Globe. We are seeing governments and industries take a war-like footing to fight it. At some point markets will begin to anticipate a recovery and begin moving higher in a sustainable fashion. It is likely that this will begin while the headlines are still grim and the economy is still in recession.

The Game Plan

Equity Markets

Right now, we are sitting on large positions of cash and gold. This has stabilized the equity portions of your portfolios and positioned you to take advantage of bargains. Once we see the bottoming process has played out we will swiftly invest in the sectors, industries and companies that have the best probability of outsized returns.

Fixed-Income Markets

We have seen big moves in the bond markets. As the market responded to Coronavirus fears, money flowed into U.S. Treasuries and out of everything else. We saw dramatic sell-offs in all aspects of the bond market including municipal bonds, corporate bonds, mortgage-backed securities and commercial paper. However, once the Federal Reserve stepped in with their purchases the bond markets began to settle down. We were able to take advantage of some of this mispricing for our fixed income portfolios.

Today, we would stick with what the Federal Reserve is buying. High Quality Municipal and Corporate bonds are most appealing in the near-term while Treasury Inflation Protected Securities offer a good longer-term hedge against inflation.

Summary

The U.S. and global economies are in a recession, global stock markets are in a bear market and at least here in the U.S. it looks like we are in the first stages of a bottoming process. This process could take weeks or months, however, if history is any guide markets will begin to recover well before the economy. Once the bottoming process is complete we can move from our defensive positions to offense.

There are strong long-term trends supporting the U.S. economy and thus our markets. The millennial generation is on the rise, as they form households and enter their peak spending years they will create a huge tail wind for economic growth. On top of this, the build out of 5G and cloud computing will only be reinforced by current events. While this is a difficult period on many levels it is also setting up to be one of the best buying opportunities we have seen in a decade. Your portfolios are well-positioned to take advantage of this opportunity when it presents itself. In the meantime, we will be patient.

The Riggs’ Report is written and published by Riggs Asset Management Company, Inc. The information contained in this Report is for informational purposes only and should not be construed as investment advice.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs Asset Management Company, Inc. (“Riggs”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure Brochure discussing our advisory services and fees is available upon request. Please Note: If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Riggs shall continue to rely on the accuracy of information that you have provided.