“The Federal Reserve…is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

Federal Reserve Chair William McChesney Marting, Jr., October, 1955.

It was a choppy ride in the investment markets for the first six months of the year. The Federal Reserve continued its path of quantitative tightening by raising its policy rate for a second time this year and projected two more hikes in 2018. The Tax Relief package out of Washington provided a lift to workers’ take-home pay and some tax relief to U.S. corporations, but the market was rattled by uncertainty over trade negotiations and the impact of tariffs on economic growth. While the investment markets may be struggling in the short term, the U.S. economy continues to be strong and on a path of stable growth. On a global basis, we are seeing signs of a slowdown in global growth momentum particularly in China and Europe. With this as a backdrop, we have become more cautious toward the investment markets. Over the past few months, we have seen some deterioration in our equity market indicators—while still positive, further deterioration could spell trouble down the road. Much like a flashing yellow light at an intersection, you can still go through but it is best to look both ways. We will continue to monitor these indicators closely and adjust your portfolios to provide protection should it become necessary.

While the trade negotiations dominate the headlines, it is the actions of the Federal Reserve that will affect investors and the global credit markets the most. Starting at the peak of the financial crisis in 2008, the Federal Reserve began to inject liquidity into the credit markets. Credit is the grease that allows the wheels of business and industry to turn. Whether it is used to finance inventory, expand infrastructure, or used to start up a new business—easy access to credit drives economic growth.

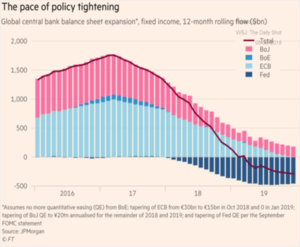

Since the financial crisis, the Federal Reserve took extraordinary measures to spur U.S. economic growth. During the six years between November, 2008 and October, 2014, the Federal Reserve quadrupled the size of its balance sheet from less than $900 billion to roughly $4.5 trillion by buying Treasury bonds and Mortgage Backed Securities. Once the economy was back on solid ground and in consistent growth mode, the Federal Reserve began to reverse course and implement a program of Quantitative Tightening. The current Quantitative Tightening program by the Federal Reserve is designed to “Normalize” monetary policy by gradually increasing interest rates while at the same time reducing the size of its balance sheet.

The reduction of the Federal Reserve’s balance sheet will have a significant impact on credit markets and the economy. Starting this quarter, the Federal Reserve will increase its sales of Treasury bonds and Mortgage Backed Securities from $30 billion a month to $40 billion a month, gradually increasing that amount to $50 billion a month in the next quarter. Just as the Federal Reserve bought bonds to create money and increase global liquidity, they are now selling bonds and having money evaporate out of the system to remove excess liquidity—essentially removing the punch bowl of easy money and excess liquidity.

We are in uncharted monetary policy waters with the Federal Reserve simultaneously unwinding the balance sheet while hiking the Federal Funds rate. Just as quantitative easing was unprecedented and had unknown consequences at the time, the quantitative tightening is also unprecedented and will have unknown consequences.

Because the U.S. Dollar is the world’s reserve currency, actions by the Federal Reserve not only affect the United States but also economies and markets around the world. We are seeing early signs that the reduction in liquidity by the Federal Reserve is beginning to affect the global credit markets. This is creating headwinds for smaller countries with weaker economies. If the trade issues are resolved and the economic backdrop remains strong, we will see the Federal Reserve continue their course of steady rate increases and bond sales. This process, taken in combination with the expanded financing needs of the U.S. Government, tells us that bond yields should move higher as bond prices move lower. However, if this is not the case, we could see an economic slowdown which would cause the Federal Reserve to reverse course. We are essentially at a crossroads where flexibility towards the fixed income markets is justified.

For fixed-income investors, short-term yields are becoming attractive. The combination of the Federal Reserve raising short-term interest rates and the expanded issuance by the Treasury has driven up the yields for bonds in the one-year to five-year maturity range. Fixed income investors are now able to capture about 90% of the yield of a 10-Year Treasury bond through shorter-term bonds. We believe the best approach in this market environment is to maintain a short-term ladder utilizing high quality municipal and corporate bonds, Treasury bonds, Treasury Inflation Protected Securities, variable rate or step up bonds, floating rate bonds and convertible securities. This approach should provide fixed income investors with the best degree of flexibility, while still generating decent returns.

EQUITY MARKETS

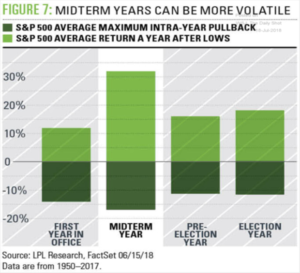

While the U.S. economic backdrop remains solid, we have seen some deterioration in our equity indicators and we are keeping a close eye on these indicators for any further signs of weakness. At this point, it appears that we are in a consolidation phase within a longer-term uptrend for equity markets. However, it is worth noting that we are now in the fifth month of a choppy sideways market and, historically, August and September are the worst two months of the year for the equity market. If you overlay on top of this that we are in a mid-term election year, the next few months could be a bit bumpy. Equity markets historically pull back in front of the election and then rally into year-end. The graphic below shows pullbacks in mid-term election years tend to be a little stronger than average; conversely, post pullback recoveries tend to be stronger yet. Therefore, simply based on historical trends, this is a time to exercise greater care/restraint in the markets.

As discussed above we have seen some deterioration in our equity indicators.

- First, we have seen a decline in market Breadth. Breadth is a measure of market strength. For example, a market where the majority of stocks are moving higher has strong breadth. Conversely, when the majority of stocks are moving down it has weak breadth. Breadth in US equity markets is neutral at the moment, but it has been waning over the past few months.

- Second, the international markets have been under-performing the US markets. Healthy market advances tend to be global in nature; with all regions of the world participating. The fact that non-US markets are under performing could be a sign that global growth is slowing.

- Last, the rise of bond yields and the reduction of liquidity is affecting some of the weaker economies across the globe.

With this as a backdrop, we are building cash in the near term to position your portfolios to take advantage of this seasonally weak period ahead and the opportunities it is likely to present. As we stated above, our expectation is that we are in a consolidation phase within a longer-term uptrend for equity markets. However, we believe that now is a good time to slow down and look both ways.

In our discussion with clients of late, we have received a number of questions regarding the impact of the trade negotiations to the investment markets as well as the global and U.S. economies.

Our base case is that the trade issues will be worked out and new trade deals will be signed. If so, we would likely see a pick-up in global growth and a strong rally in global markets. This will no doubt create investment opportunities. However, if the ongoing process continues, we are likely to see a significant slowdown in the European and Chinese economies and the negative effects would likely spill over to the United States. As of yet, we have not reached that point.

So, how do things stack up?

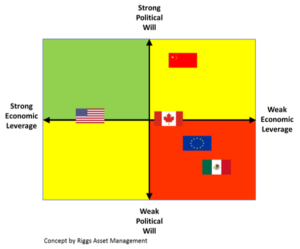

There is more involved when discussing trade than just economics, one must also consider the political leverage that a country brings to the negotiating table. How much interest/motivation is there to make a deal? How much political fallout will a leader risk by making a deal? Does a leader of his/her county have the authority/legitimacy to make a deal? The chart above shows where, we at Riggs think some of the major countries lie in relation to not just their economic leverage, but also their political leverage.

For example, we believe the United States has more economic leverage, than other countries, but that it lacks the political leverage that a country like China—which is an authoritarian regime and therefore less concerned about political blowback—would have.

China and Germany

China and Germany are the second and third largest economies in the world. Germany is also the largest and strongest economy in the European Union. Therefore, anything that affects Germany affects Europe as a whole. Both China and Germany are export driven economies, with approximately 38% of China’s and 48% of Germany’s economy dependent on exports. While not all of these exports flow to the United States a great deal do. The table below is a good depiction of trade imbalance between China and the United States.

Both China and the European Union have significant economic concerns. China is trying to unwind a real estate and debt bubble that threatens its economy. Europe is trying to manage a huge debt and banking stability issue while also negotiating Brexit. These issues are manageable as long as their respective economies continue to grow. A slowdown in global trade would create significant economic issues for both China and the European Union.

It is in the political realm where the difference between China and the European Union stands out. China’s President Xi Jinping has spent the last five years consolidating power and is the most powerful leader of China since Mao Zedong. Conversely, the European Union is an unwieldy federation of independent countries each with differing needs and desires.

Therefore, while both Europe and China have their issues, China is better equipped to navigate trade negotiations with the United States.

Therefore, while both Europe and China have their issues, China is better equipped to navigate trade negotiations with the United States.

Canada and Mexico

Once again, there are different forces affecting the process. The trade balance between Canada and the United States is relatively balanced. The biggest issue is transshipments from other countries through Canada and the Canadian government subsidizing industries that ship to the United States (which of course we do as well). Politically, Canada is stable.

Mexico, on the other hand, has some real issues. Without going in to all of them, the major ones are:

- Large portions of the country are controlled by drug cartels, with little government influence.

- The violence in Mexico is extreme with four people murdered every hour.

- The wealth disparity is enormous.

The President Elect of Mexico López Obrador has indicated he wants to make a deal so that he may focus on Mexico’s internal issues. Mexico does have a large trade surplus with the United States; however, this is largely due to the trade and tax policies of the United States, not Mexico. Therefore, it is likely the negotiating process will move along more quickly once President Elect López Obrador is in control.

United States

The United States is the largest and most diversified economy in the world and is less dependent on exports than other countries. This gives the United States an inherent advantage in trade discussions.

For the United States, less than 14% of the economy is dependent on exports. This gives the United States an economic advantage in trade negotiations as we have less to lose and more alternatives. President Trump’s stated goal in trade negotiations is to bring manufacturing back to the U.S., however, the United States has not been investing in the infrastructure or work force training to support manufacturing the way other countries have. In fact, over the past few decades we have incentivized companies to offshore their manufacturing processes. It would take some time to reverse this trend. Regardless, simply based on the raw numbers the United States has the most economic leverage in trade negotiations.

Mid-term elections are just around the corner and their outcome could affect the administration’s political flexibility in trade negotiations. President Trump has brought these issues to the forefront and would likely lose political support if he fails to show progress on trade. President Trump maintains a slim majority in Congress and a divided electorate. However, despite the opposition he faces, these issues have been percolating for some time and were a point of contention for the last two Administrations as well. We, therefore, rate the United States as only slightly positive with regard to political will.

Summary

Our base case is that the trade issues, will be worked out and eventually new trade deals will be signed. With the US economy on a solid growth path, a resolution of the trade issue could reset the stage for continued global growth. However, if this remains a protracted issue then it is likely we will see a significant slowdown in China and the European Union, the effects of which would spill over to the US economy.

While the trade negotiations garner all the headlines and certainly have had an effect on the investment markets, perhaps more important to the investment markets is how skillfully the Federal Reserve manages their quantitative tightening program. The actions of the Federal Reserve and the uncertainty around the trade negotiations could spook the investment markets and so we want to tread carefully right now. With that as the backdrop, we are also heading into a seasonally weak period in the market with mid-term elections looming. Our philosophy is that wealth is built by not only making money but also managing risk. As we see some elevated risk in the markets, we have built up some cash in your portfolios to first protect the portfolios and to take advantage of investment opportunities should the markets pullback.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.