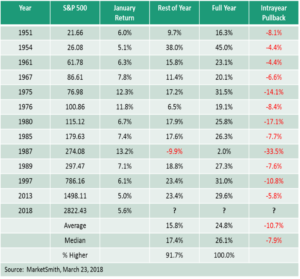

The first quarter of 2018 started with a bang as January proved to be a strong month providing a continuation of last year’s rally. Since then, the stock market has faded and volatility has returned. The return of volatility is especially pungent given that 2017 had the lowest stock market volatility in history. We see this as a return to normal and healthy market conditions. It is worth noting, that since 1950 there have only been 12 previous years with strong Januarys, in every case the stock market closed higher at the end of the year. We will see how 2018 fares, but history bodes well for positive returns in stocks.

Economy and the Bond Market

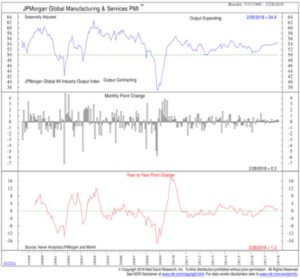

The economic backdrop remains positive for global growth. While the first quarter is typically the weakest quarter of the year, economic indicators point to continued growth. The combination of relatively neutral monetary policy accompanied by the recent reduction in corporate taxes should provide a solid underpinning for the US economy. Beyond the US, global growth remains positive with developed economies leading the global growth story.

As the chart indicates, output as measured by the JPMorgan Global Manufacturing & Services Purchasing Managers Index remains strong. This growth is translating into an improved jobs market and higher wages.

For Fixed Income Investors:

The Good News is the Bad News

While trade concerns have kept the stock market’s recent volatility in the headlines, so far it has been fixed income markets that have fared the worse this year. Year to date, the US Treasury Bond benchmark provided a total return of -3.29% with interest payments included. Oddly enough, the underperformance by the bond market was not driven by headlines, but rather the steady positive performance of the economy.

The improvement in the jobs market here in the United States is putting pressure on the bond market. As the economy improves, businesses need to hire more people to keep up with demand. In the early stages of an economic recovery, there is an oversupply of workers as many people are either unemployed or under employed. However, as economic conditions improve, the demand for workers grows; this process eventually puts upward pressure on wages. One of the best measures of the health of the jobs market is weekly wages. Weekly wages is a more comprehensive measurement of compensation because it includes both salaries and benefits. For today’s work force, benefits have expanded beyond just health care and retirement packages to include things like education, wellness and lifestyle programs.

As you can see, the growth in weekly wages is at its highest point since the 2011 post recession surge. More importantly, weekly wages are improving across all industries. The breadth of the improvement in weekly wages indicates that the United States economy may be moving towards a higher level of sustainable wage growth.

While this is good news for workers and the economy, it is bad news for fixed-income investors. Interest rates here in the United States—and, for that matter, across the globe—remain at very low levels. However, as the economy continues to improve the demand for goods and services will increase putting upward pressure on inflation, thus driving up interest rates and driving down bond prices.

Historically, the Federal Reserve has been extremely sensitive to wage pressure and wage inflation. We are not at a point where wage inflation should be a concern. However, the fact that wage gains are improving and seem to be broad-based will provide the Federal Reserve the impetus to maintain a steady series of interest rate increases in order to dampen future inflation. The bottom line is interest rates should continue to rise putting downward pressure on bond prices.

For fixed-income investors, we believe the best approach in this market environment is to maintain a short-term ladder utilizing high quality municipal and corporate bonds, Treasury Inflation Protected Securities, variable rate or step up bonds, floating rate bonds and convertible securities. With early signs of inflation, gold could be a good hedge for fixed-income investors. We would avoid long-dated securities or funds with long durations.

The Equity Markets and the Return of Volatility

As we discussed in our 2018 Investment Outlook, “Our expectation is that U.S. equity markets will return to normal levels of volatility over the course of 2018, which means three to four pullbacks of around 5% and perhaps a couple of pullbacks of 10% or greater. This would simply be a return to normal market behavior.” This is exactly what we have seen so far this year: a strong January followed by a correction in February and March.

While corrections are unpleasant, they provide a necessary function by relieving excess enthusiasm. Much like a spring storm clears the air. Our base investment thesis is:

- That the global economy is in a confirmed economic expansion;

- Asset prices including Equities, Real Estate and Collectibles remain expensive; and

- Interest rates are gradually moving higher and away from crises level low yields we have seen for the past ten years.

These three themes in combination indicate equity markets should continue to move higher but with increased volatility.

Currently, our indicators tell us that this current market environment is a normal correction within a long-term up trend. However, if our primary indicators begin to show signs of deterioration we will aggressively move to a more defensive posture; which would include higher cash positions, adding short-term Treasury bonds and increasing our gold position.

For now, we continue to like Technology, Financials and Industrials and believe they will remain market leaders for some time. Goods producing industries and companies such as Manufacturing and Construction should also do well in this environment. Beyond this, we like Emerging Markets and resource-rich countries, both of which should benefit from expanding global demand.

Summary

Economic growth remains on good footings both in the U.S. and across the globe. However, this environment will likely create inflationary pressures that will challenge the fixed-income markets. While the equity markets will remain more volatile than last year the longer-term trend remains intact and we are looking for the markets to gradually move higher.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.