VOLATILITY HAS RETURNED

After the 2018 fourth‐quarter meltdown, the stock market returned to its low volatility ways. There were 87 trading days since the last 3% correction. Not only was the current stretch abnormal from a duration perspective, it was unusual coming off a low. Perhaps it was the Federal Reserve “Pivot” that lulled the market into complacency. In January, the Federal Reserve made an unexpected 180 degree policy change from increasing interest rates and signaling the end of its quantitative tightening policy to contemplating an interest rate cut. That policy change was akin to the Federal Reserve taking the punchbowl from the party and just as the party was winding down bringing the punchbowl back out again. As a result, market volatility subsided and it was rally on mode for the 1st quarter of the year.

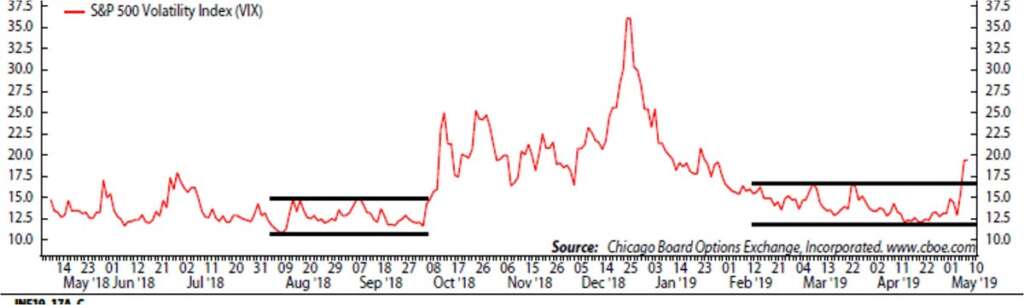

The S&P 500 averages 3.4 corrections of at least 5% and 1.1 corrections of at least 10% in any given year. With the rhetoric on U.S./China trade negotiations ramping up, volatility finally resurfaced this week. As the chart below illustrates, volatility broke out against the three‐month low volatility band.

So what does it mean now? Ultimately, the fundamentals matter. Whether and when a trade deal is reached will determine the level of volatility. But the underlying strength of the market heading into the turmoil can have a say in the amount of downside risk. Our research indicates that extreme optimism (too many investors leaning in one direction) has left the market vulnerable to a pullback. The quality of any pullback will determine if it is part of a topping process or a healthy reset before a push to new highs.

As you know, since the market correction last year, we have kept your portfolios positioned for a possible retest of the market lows. The Federal Reserve policy pivot did impact our retest expectations but the quickness in investor sentiment from extreme pessimism levels to extreme optimism levels kept us cautious. We are closely watching the fundamentals and technicals of the market to determine if this is a typical pullback or if we may see a re‐test of last year’s market lows. In either scenario, we have positioned your portfolios to weather the volatility with an increased allocation to fixed income, a gold hedge and a buildup of cash reserves. If the market fundamentals strengthen, we will use this pullback to add to our equity positions. If the market fundamentals deteriorate, we will keep your reserves “dry and on the sidelines.”

Since the beginning of the year, there have been no net inflows into equity ETFs and mutual funds. While corporate buybacks have driven the market higher, the lack of inflows into equity funds is an indication that there is quite a bit of demand building up on the sidelines from individual and institutional investors. When the all clear signal sounds, the next move higher in the equity market could be a powerful one as demand from all areas moves strongly into the market. Your portfolios will be well‐positioned to take advantage of the next leg in the cycle.

The Riggs’ Report is written and published by Riggs Asset Management Company, Inc. The information contained in this Report is for informational purposes only and should not be construed as investment advice.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs Asset Management Company, Inc. (“Riggs”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure Brochure discussing our advisory services and fees is available upon request. Please Note: If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Riggs shall continue to rely on the accuracy of information that you have provided.