The Status of the U.S. Dollar as the Reserve Currency

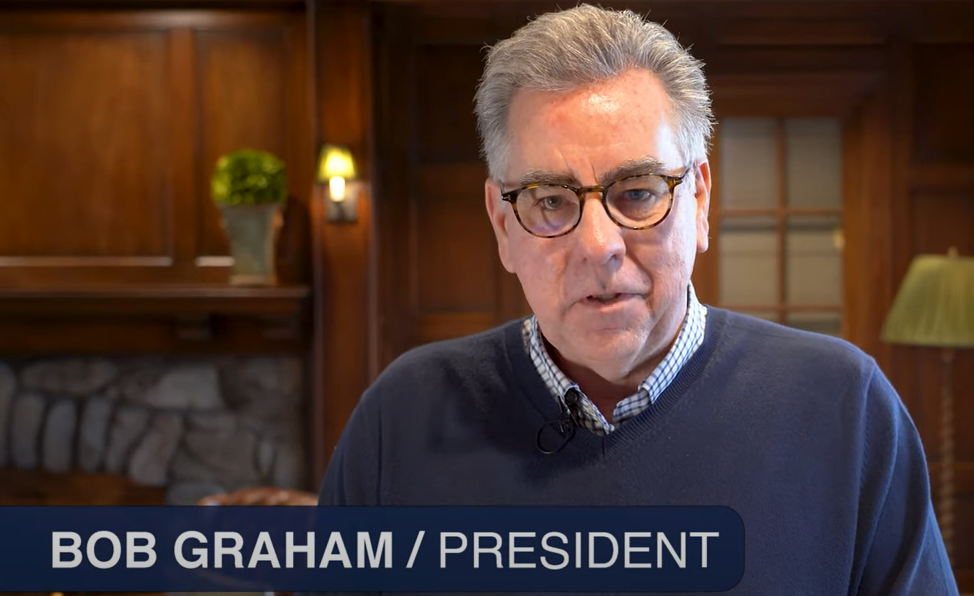

Recently a client asked us: “what is the status of the U.S. Dollar as the reserve currency?” Bob Graham sat down recently to talk about this issue. Click the picture for the video.

“I want to talk about one of the questions that we’ve been getting a lot lately, and that is what’s the status of the U.S. Dollar as the global reserve currency? And how does the changing environment, the globalization in some of the, if you will, bilateral trade deals we’ve seen from other countries—whether it’s Brazil and China or Saudi Arabia and India or China—how have these things changed the Dollar’s status as the reserve currency? To really understand that, you have to actually go in and look at the deals that the different countries are cutting with each other. So, for example, Brazil says to China, I want to sell you my soybeans, but I want you to pay me in Brazil Reals. And China says, that’s fine, but you have to buy my whatever, let’s say toasters in Chinese Yuan. And they say, okay, we’re going to do that.

But then when you open the deal up, you find out that backing both of those currencies is not the sovereignty and goodwill of the country but rather gold. So what you really have is bilateral trade deals being done that are backed by gold. And in fact, interestingly enough, in 2022, we saw gold held by Central Banks around the world has more than doubled. And they have to do that because if they’re going to do those kinds of deals, they have to have the gold to back them. And they have to have the gold to exchange gold for toasters, gold for soybeans, if you will, is really what we’re seeing. So yeah, the demand for U.S. Dollars has gone down, but it has not changed the U.S. Dollar’s status as the global reserve currency. We saw a lot of talk back when the Euro was first coming out, that that was going to be the new reserve currency, or at some point in time it was going to be the Japanese Yen, or Russia wants it to be the Russian Ruble.

Source: Visual Capitalist

And that’s not going to happen. And China clearly wants it to be the Chinese Yuan, but it’s unlikely that any of those things are going to occur. But what we are seeing is a huge demand in gold, and quite frankly, there’s not enough gold in the world to be the reserve currency. We saw that going up before 1971 when we came off of the Gold Standard. So yeah, there’s a lot of changes. The U.S. Dollar is integral to global trade, and that is probably not going to change anytime soon. But what is changing is that the demand for gold is going up tremendously.”