Riggs’ clients had a good year in 2013 with both our equity and fixed income portfolios performing well. It was also a transition year where we saw the largest outperformance by stocks over bonds since 1958. We believe this is a theme that we will see replayed for many years to come.

So, with 2013 in the books what are our expectations for 2014?

- Our research indicates that we could see the U.S. economy grow in the 2.5% to 3% range. While not robust, it would be the best growth the U.S. economy has seen in 6 years. We also expect to see continued economic improvement in Europe and Japan. With this as a back drop, we should see the unemployment picture continue to improve.

- With an improving economy and unemployment rate, the Federal Reserve has stated that it will begin to reduce its monthly purchase of fixed income securities. Under its Large Scale Asset Purchase Program (LSAPP), the Federal Reserve is purchasing fixed income securities at a rate of $85 Billion a month. This reduction in purchases will likely put upward pressure on interest rates and cause another difficult year for U.S. fixed-income investors.

- While 2013 was a very good year for U.S. equity investors, we are now at a point where stock valuations are stretched and sentiment is high. Further, 2014 is a mid-term election year and historically the U.S. stock market tends to be more volatile during election years. We expect to see forward momentum in the equity markets during the first part of the year. However, a pullback mid-year would be healthy for the markets and in line with historical tendencies during election years. Our expectation is that we may see a rally into year-end that could provide year-end gains for U.S. equity investors.

We believe that fixed income investors will need to be defensive and continue to keep maturities short to protect their portfolios. U.S. equity investors are likely to see a correction this year but indications are that the year may still end on a positive note. As a result, our approach is to take some profits once our signals turn and transition to a more defensive approach during any correction. We will use any correction as an opportunity to buy at discounted prices and take advantage of a year-end rally. All in all, it is likely that this year will require investors to be more nimble in order to protect the gains achieved in 2013 and to realize more growth into year end.

The U.S. Fixed Income Market Faces Headwinds

Our outlook for U.S. economic growth this year is 2.5% – 3%. This would represent the best growth we have seen in the last 6 years. While not robust by historical standards, it would be a significant improvement. As you will recall, last year at this time U.S. economic growth was anemic, the government was gridlocked, and American workers were facing the largest tax increase in decades. At that time, the Federal Reserve began its Large Scale Asset Purchase Program (LSAPP) where it began purchasing $85 Billion of Mortgaged Backed Securities and Treasuries each month. Over the course of 2013, the Federal Reserve became the largest purchaser of U.S. debt securities in the world and expanded its balance sheet by $1,112.22 Billion. The purpose of LSAPP was to add support to a muddling economy, promote employment, and boost asset prices. Now a year later, the economy did improve, asset prices as measured by housing and the stock market moved higher, and the official unemployment rate is lower today than it was a year ago. So, arguably LSAPP was successful.

While these types of policies can provide a short term boost, they are not sustainable and can over time debauch a country’s currency. This is why the Federal Reserve has been looking for a way to wean the U.S. economy from its LSAPP. During the first part of last year, interest rates were relatively stable. However, once the Federal Reserve began discussing tapering their bond purchases, we saw one of the most violent corrections in the bond market in years. Yields on 10-Year Treasuries rose from about 1.6% to just over 3%, mortgage rates rose from 3.5% to over 4.5%, and longer term bond prices fell by roughly -15%. In fact, 2013 was the worst year for fixed-income investors since 1994. Keep in mind that this volatile movement in the fixed income market occurred simply because the Federal Reserve began to talk about reducing their bond purchases.

At the end of last year, the Federal Reserve stated that they would begin to reduce their monthly bond purchases starting this month. Our expectation is that by late summer or early fall of this year, they may no longer be actively purchasing Mortgage Backed Securities or Treasuries. Going forward the combination of an improving economy and a Federal Reserve gradually backing away from its bond purchases should cause interest rates to generally move higher and bond prices to generally move lower. This year may be a tough year for fixed-income investors.

For those who want or need to be in fixed income, we recommend a conservative approach with higher quality tax-free bonds being a better “relative” value.

As we stated above, we believe that the major headwind facing our economy is the massive level of debt we have accumulated. While personal debt has come down over the past six years, government debt has increased dramatically both in absolute terms and relative to our economy, while the service (interest payments) on this debt has remained somewhat stable. The stability of the government’s debt service payments is largely due to the Federal Reserve keeping interest rates artificially low. Should interest rates rise, so would the government’s debt service payments.

It is in the federal government’s best interest to promote inflation which would effectively reduce the value of existing debt (bonds). In this way they can service the debt with ever cheaper dollars. For savers and fixed-income investors it means that they will be slowly starved of any real return. To put this in some perspective, the last time we saw an environment like this was the post-WWII era from the mid 1940’s through 1981 where fixed income investors lost over 90% of the value of their holdings in real or inflation adjusted terms. However, these polices also ushered in one of the best bull market periods for the U.S. stock market.

U.S. Stock Market Benefits from Tailwinds

The year 2013 was a good year for equity investors. The year began with many concerns—from lackluster economic data, dysfunction in Washington, tax increases, and the beginning of Large Scale Asset Purchases by the Federal Reserve. As we wrote in our 2013 Investment Outlook:

Our 2013 equity outlook is relatively positive. The aggressive actions of the Federal Reserve and other Central Banks around the globe support this outlook. The announced expansion of the Federal Reserve’s QE program is the most aggressive since 2008. The combined actions of the Federal Reserve and other Central Banks around the globe should put a floor under economic growth and help boost asset prices. The equity market should be the primary beneficiary of these programs.

Our outlook proved to be correct.

As we enter 2014 the backdrop has changed significantly. Economic data is much improved and we will likely see the best economic growth that we have seen in some time. While partisan bickering still reigns in Washington, at least some in Congress are beginning to speak to each other as the recent budget deal indicated. Finally, the biggest signal of economic improvement is from the Federal Reserve who have announced their plan to wind down LSAPP.

With this background, we enter 2014 with some concerns for the equity markets. These concerns broadly fall into three major areas: 1) equity valuations, 2) investor and market sentiment, and 3)

the historical market tendencies during election years.

First to valuations, as the chart illustrates valuations are becoming extended. While, not extended to the point they were in 2000 or 2007 the stock market is not cheap. To put this in some perspective, the Median Price to Earnings ratio for the S&P 500 is 21.3 as of 12/31/13. The 50-Year average of the Median Price to Earnings ratio is 16.7. By this measure, the market is a little over 20% overvalued.

First to valuations, as the chart illustrates valuations are becoming extended. While, not extended to the point they were in 2000 or 2007 the stock market is not cheap. To put this in some perspective, the Median Price to Earnings ratio for the S&P 500 is 21.3 as of 12/31/13. The 50-Year average of the Median Price to Earnings ratio is 16.7. By this measure, the market is a little over 20% overvalued.

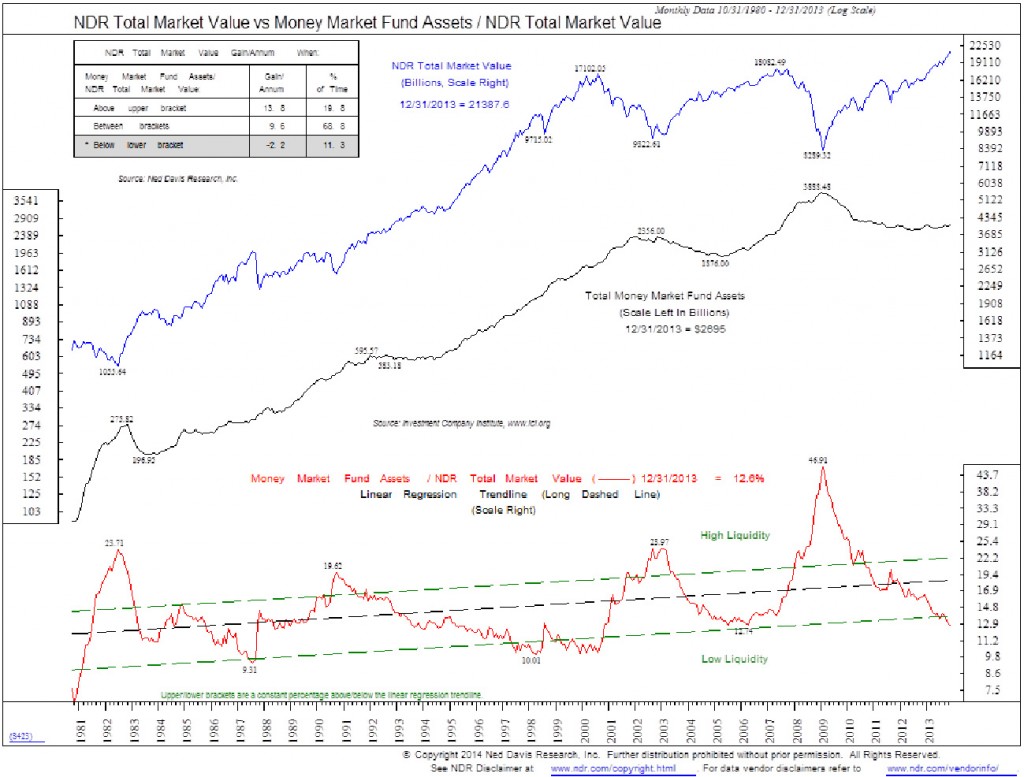

Valuation can also be considered a form of sentiment indicator, as investors become more confident with a market they put more and more money into it until most investors are fully invested and there is no one left to buy. This tends to be the point of highest enthusiasm. One way to measure sentiment is to look at the amount of money held in money market accounts. As the chart illustrates, money markets as a percentage of the equity market are at their lowest level since 2000.

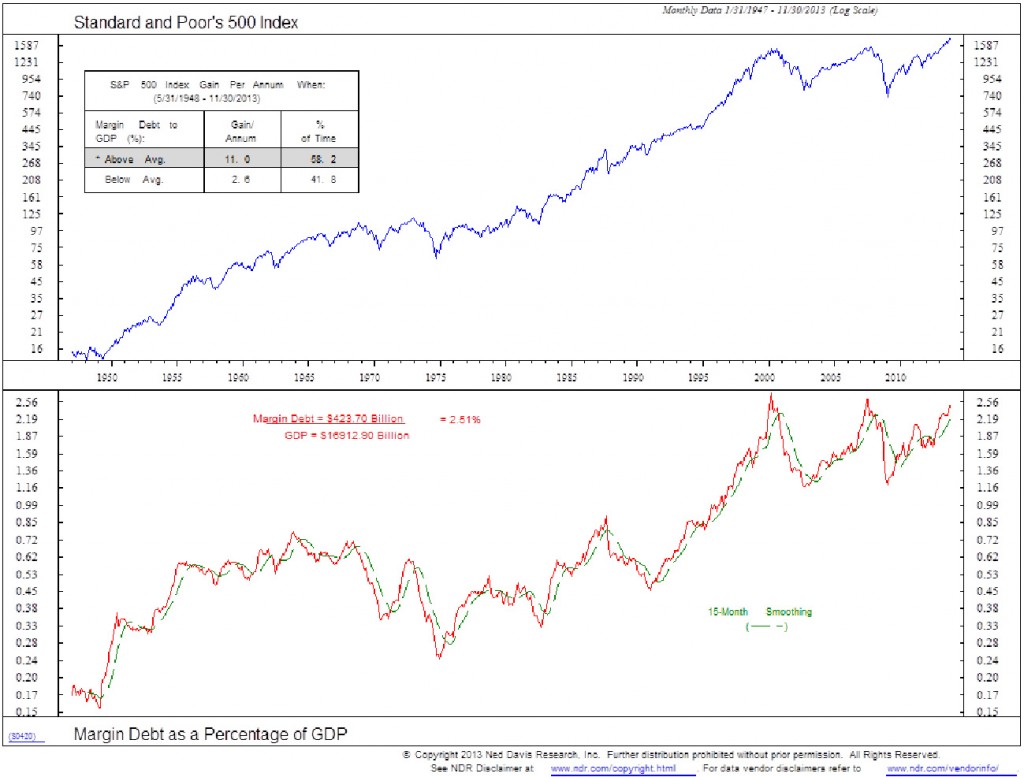

Another sentiment indicator we monitor is margin debt. As the chart illustrates margin debt as a percentage of GDP is approaching levels last seen in 2000 and 2007.

While low money market levels and high margin debt balances can be, in part, due to the Zero Interest Rate Policy of the Federal Reserve, it represents a risk to investors. Much like a shock absorber that helps a car absorb the inevitable “bumps in the road,” cash does the same thing for investment markets. Without cash on the sidelines to act as a buffer, any market pullback may be felt more keenly by investors.

Finally, mid-term elections will occur in 2014. Historically, during mid-term election years the market tends to do well during the first phase of the year and then as the rhetoric escalates in the spring and summer the market tends to pull back and finally rallies in the fall as the results of the election become more clear. The median gain of the S&P 500 has been 6.9% in all mid-term election years since 1948.

Given the extended valuations of the stock market, high sentiment of investors, and the normal historic tendencies during an election year, we believe that a correction in the stock market this year is probable. Our best guess is that we could see the markets pull back this year in the range of 20% give or take.

With that as the backdrop, our strategy is to let portfolios continue to grow while the markets remain in gear. As we see our technical and fundamental signals begin to turn, we will move to a higher weighting of cash and defensive holdings. We will use cash and defensive investments to preserve principal during any correction and we will use a correction in the equity markets as an opportunity to invest at discounted prices and allow holdings to appreciate going into a year-end rally.

We believe that the markets are in transition, with U.S. equity markets moving into a long-term (a decade or more) bull market and with U.S. fixed income markets moving into a long term bear market. As a result, our orientation has transitioned from a balance of equities and fixed income to a higher orientation to equities and a lower orientation to fixed income. We believe that the equity markets will continue to benefit from economic tailwinds but the fixed income markets will continue to face headwinds.

Riggs Asset Management will be hosting an investment webinar on Tuesday, January 28th at 12:00 PM (EST) where we will outline in further detail what we are seeing in the investment markets. Please keep an eye out for an upcoming invitation to the Webinar. In the meantime, please let us know if you have any questions.