2015 was a disappointing year for most investors. With the stock, bond and commodities markets all down for the year, investors had few opportunities to make money. Perhaps the best description of 2015 was that this past year was like taking a ride on a roller coaster – lots of action little progress.

The chart to the right shows the S&P 500 Index Cap-Weighted (black line) and the S&P 500 Index Equally-Weighted (red line). The fact that both were down for the year indicates that most stocks regardless of whether they were Large Cap, Mid Cap or Small Cap struggled. On an equally-weighted basis, the S&P 500 was down -7.19% in 2015.

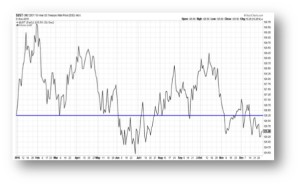

Typically, when stocks are under pressure you are able to counter that with opportunities in the bond market. However with the anticipation of a short-term rate hike looming all year, the bond market also struggled. This chart illustrates the price action of the 10-Year Treasury bond—again lots of volatility but no progress.

With pressure on both stocks and bonds, it is little wonder why 2015 was described as the most difficult year for investors since 2008. However, whenever volatility and dislocations occur in the market, opportunities usually follow. So while we see some potential risks both economic and geopolitical, we also see areas of opportunity for investors.

2016 Opportunities

Equity Markets

While growing at a slow pace, the U.S. economy still remains the strongest economy on a per capita basis in the world. Investors have shown that they will pay a premium for companies that can grow in a slow economic environment. Since the 2008 financial crisis, the Pharmaceutical Industry has served as one of the strongest areas for growth fueled by an aging population, scientific breakthroughs, and significant merger/acquisition activity. In 2015, the Pharmaceutical Industry was reluctantly pulled into the U.S. Presidential Campaign and this in combination with some earnings slowdown caused significant volatility in pharmaceutical stocks. We believe this area may resume its growth path in 2016. Further, we continue to see strong growth prospects in the technology area, consumer discretionary, and certain financial companies.

In December, the Federal Reserve finally pulled the trigger and moved off of its Zero Interest Rate Policy (“ZIRP”). While the financial press has clamored on about the Federal Reserve’s action to move away from ZIRP by increasing interest rates by 25 basis points, the effective change was an increase of about 15/100th of a percentage point—not exactly earth shattering. However, we do believe this is a step in the right direction, especially for savers and people living on a fixed income.

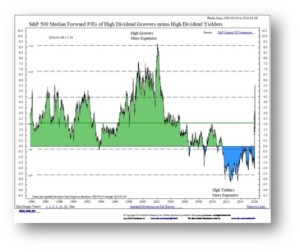

As investors realize the little net effect the change in Fed policy had on yields, they are forced to continue to look to the stock market for income opportunity. In a low yield environment, companies who can grow their dividend and provide the opportunity for growth are likely to be rewarded by investors. This is an area where we see opportunity for clients. As the chart shows, high dividend yielding stocks are expensive right now but high dividend growers are not.

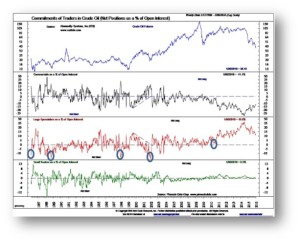

With the precipitous drop in oil, we are now starting to get questions of “are we near the bottom.” While we will only know the bottom in hindsight, our answer on oil is “not yet.” In every bottom in oil prices, traders were either net short or net neutral. As you can see from the red line on the chart, large speculators are still net long so it seems as if oil stability is still premature. We are keeping an eye on oil and there may be some opportunities in this area in the future.

As you know, one of the by-products of the Federal Reserve’s quantitative easing policy was the rise in the U.S. stock market as investors sought opportunities to grow their investment dollars. Now that the U.S. economy is on more solid footing, the Federal Reserve has been systematically stepping back from this easing policy by reducing its bond purchases and initiating the first interest rate hike in years. While our government is tightening monetary policy, Japan and the European Central Banks are still accommodative with their monetary policy. Should oil stabilize, you could see economic growth and investment markets pick up in those countries with more accommodative monetary policies. While we have found our best investment opportunities in the United States of recent, other areas of the world are beginning to pique our interest.

Fixed Income Markets

On the fixed income side, the bond markets are in a period of transition as the Federal Reserve works to move short-term rates higher and to a more normalized level reflective of our economy. While the Federal Reserve is moving short term rates higher, other major economies around the globe from Europe to Japan and China are moving in the other direction. Therefore, it is likely that even as the Federal Reserve moves towards more normal short-term rates, the difference in policies between our major trading partners will keep longer-term rates relatively low.

The path to normal short-term rates could take a very long time, perhaps a few years. We continue to recommend taking a conservative approach to the fixed-income markets, where we opportunistically add to positions taking advantage of the volatility in the markets.

While we see a number of opportunities in 2016, there are still a number of headwinds that we are watching carefully.

Global Headwinds

Oil Needs to Stabilize

Looking around the World, Russia, Ukraine, the Balkans and Latin America all experienced recessions in 2015 caused largely by the drop in oil prices and the slowdown in China. If oil doesn’t stabilize, it will have far-reaching economic and geopolitical consequences. Russia and Brazil are expected to remain in recession in 2016. Further, should oil prices continue to decline, it could further destabilize OPEC Nations. In order to offset the national income lost by the decline in oil prices, they may have to resort to the liquidation of other assets. A forced and fast sale of assets could have far reaching effects in the global economy. The oil price decline remains a significant risk.

Can China Execute A Soft Slowdown?

The slowdown in China will continue to present a risk to the global economy. As Mohamed El-Erian stated in a recent Op Ed:

The 2008 global financial crisis, coupled with the disappointing recovery in the advanced economies that followed, injected a new urgency into China’s efforts to shift its growth model from one based on investment and external demand to one underpinned by domestic consumption. Navigating such a structural transition without causing a sharp decline in economic growth would be difficult for any country. The challenge is even greater for a country as large and complex as China, especially given today’s environment of sluggish global growth. For years, China’s government sought to broaden equity ownership, thereby providing more Chinese citizens with a stake in a successful transition to a market economy. But, like the United States’ effort to expand home ownership in the years preceding the 2008 crisis, Chinese policies went too far, creating a financially unsustainable situation that implied the possibility of major price declines and dislocations.

As a result, the adjustment challenge has grown dramatically. With Chinese companies no longer able to sell a rapidly increasing volume of products abroad and support further expansion of productive capacity, the economy has lost some important growth, employment, and wage engines. The resulting economic slowdown has undermined the government’s capacity to maintain inflated asset prices and avoid pockets of credit distress….A surprise (Yuan) devaluation last August has been followed by a number of lower daily fixes in the onshore exchange rate, all intended to make Chinese goods more attractive abroad, while accelerating import substitution at home.

…But in pursuing its domestic objectives, China risks inadvertently amplifying global financial instability. Specifically, markets worry that renminbi devaluation could “steal” growth from other countries, including those that have far more foreign debt and far less robust financial cushions than China…

Project Syndicate, Mohamed El-Erian, January 11, 2016

As China transitions from an economy driven by foreign demand for their goods and services to one driven by domestic consumption, it would not be surprising if there were bumps in the road during the transition. Certainly the effect on the investment markets in recent weeks from the slowdown in China would indicate that risk is real.

U.S. Headwinds

High Valuations

The Federal Reserve ended its bond purchasing program in October of 2014. Since that time the stock market has entered a volatile sideways pattern. At this point, the Federal Reserve is unlikely to reinitiate its Quantitative Easing or bond purchase program unless we see a significant slowdown in the U.S. economy. Therefore, we are in a transition period as the markets adjust to an environment based not on the actions of the Federal Reserve but rather based on economic and company specific fundamentals.

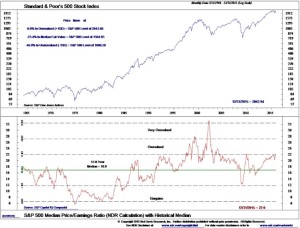

Excluding the 1990s/early 2000s bubble period, the market has been unwilling to push the median P/E for S&P 500 stocks above the 22-24 range. With a current median P/E of 22.2, multiple expansion could prove difficult.

2015 was a tough year for earnings. The market was expecting operating earnings for the S&P 500 to come in somewhere between $120 and $125. Today, those earning are coming in at approximately $106 to $107. This is an unprecedented decline. It happened because of the collapse in oil prices and the strength of the U.S. Dollar. For companies in the S&P 500, 40% to 45% of profits are earned abroad. Further the Index is heavy with energy companies and heavy with industrial companies that supply to the energy sector. As a result, anything that pounds energy is going to pound the S&P 500. A stabilization in energy is crucial. We believe through layoffs and cost cutting, we should see some stabilization in the energy sector. This should translate into a better earnings numbers and somewhat improve the valuation backdrop moving forward.

Presidential Elections

High valuations and a Federal Reserve that is no longer overtly trying to prop up asset prices means we will likely see market volatility continue. Further, Presidential Election years are usually volatile. A typical pattern during a Presidential election year is a market with high volatility that continues until the winner of the election becomes apparent. Once the winner of the election becomes clear, the markets usually respond by rallying higher.

Summary

We believe that the volatility that was endemic last year will likely continue in 2016. This volatility should create some opportunities in both the equity and fixed income markets. On the equity side, we believe companies that can deliver growth in this slow growth economic climate will be rewarded. We also believe those companies that are growing their dividends are attractive as investors search for income opportunities. We currently favor health care, technology and some financial companies. We are also keeping an eye on energy as an opportunity should the energy market stabilize as well as opportunities outside the United States. On the fixed income side, the bond market is still in transition so you need to be opportunistic.

While we are seeing some opportunities, there are headwinds to growth—further slowdown in China, the collapse in oil, high valuations, and volatility brought on by Presidential Election rhetoric. Our approach to the markets will be to take advantage of opportunities that volatility may provide and, when necessary, raise cash to protect portfolios. Our indicators still point to a market that ends the year higher so while we see a bumpy road in 2016, we also see opportunities to make money.

****************

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs Asset Management Company, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.