2017 was an excellent year for the investment markets and the global economy. We saw acceleration of economic growth in the U.S. and abroad which led to increased global trade. Companies have been beating their estimated earnings projections; and as a result, U.S. equity markets went on a tear. With such a strong year, the question on everyone’s mind is “can 2018 keep up?”

Looking forward, we see further improvements in economic growth. Our research indicates that the U.S. could experience GDP growth approaching 3% in 2018. If so, this would be the fastest economic growth in over a decade.

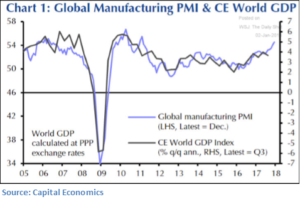

Further, this expansion is broadening across the globe. Currently, there is not a single major economy in the world that is not in an expansion mode as indicated by Global Manufacturing Purchasing Managers Index (GMPMI). GMPMI tends to lead economic growth. Thus, economic expansion remains strong with no signs of recession on the horizon.

All in all, we are optimistic for our outlook for 2018. While equity values in the U.S. are stretched, faster growth is a positive tailwind. However, what is a tailwind for equities represents a headwind for bond markets. The U.S. bond market has underperformed the U.S. stock market for five years and it would not surprise us to see continued sub-par returns in bonds, if not actual declines. Improving economic growth could cause inflation to pick up which will keep the Federal Reserve on their current path of increasing short-term interest rates. Outside of a geopolitical event (which tends to be short-lived), we believe the greatest risk to global economic growth and the investment markets remains a misstep by one of the major Central Banks.

Economy and Bond Markets

For the first time since before the Great Recession in 2008-2009, we are seeing the global economies expand in harmony. As we discussed in our July 2017 Riggs Report, this global expansion is increasing the upward pressure on base metals (metals widely used in commercial and industrial applications such as construction and manufacturing).

Another positive sign of economic expansion can be seen in the S&P GSCI Industrial Metals Index which reflects the pricing of five different widely used Industrial (Base) Metals—Aluminum, Copper, Zinc, Nickel and Lead. The pricing of industrial metals can act a bit like “a canary in a coal mine” in that as long as the air is clean, the canary continues to chirp; or in this case, as long as the global economy remains healthy, the demand and price for industrial metals remains strong. For now, base metals are indicating that the global economy remains strong. Along with the rise in base metals, we are seeing manufacturing jobs in the U.S. growing at the fastest rate in three years which is putting upward pressure on wages.

Expanding U.S. and global growth, rising base metals prices, rising energy prices and increases in employment all point toward rising inflation. How long this expansion phase could last is not certain. For the last decade, large portions of the global economy have been in rolling recessions or worse. As these economies improve, the demand for goods and services should grow that could create a domino effect where growth creates demand and demand produces more growth.

Economic growth will cause Central Banks across the globe to become less accommodative as they move from being concerned about disinflation to being concerned about inflation. We have already seen this process begin with the U.S. Federal Reserve leading the way. The Federal Reserve ended its bond purchasing program in 2014 and has gradually raised short-term interest rates. In the last quarter, the Federal Reserve began to sell off small portions of its balance sheet. At their December, 2017 Federal Reserve Board meeting, the Federal Reserve signaled that there would be three more rate hikes in 2018 and is expected to accelerate the sales of treasuries and mortgage-backed securities from its balance sheet.

The European Central Bank (ECB) is about four years behind the U.S. in removing its extraordinary accommodative policies. Starting in January, the ECB cut its bond purchases in half, from €60 Billion to €30 Billion a month. It is now expected that the ECB could end its bond purchasing program as early as September of this year. This in combination with the actions of the Federal Reserve could cause turbulence in the bond markets, just as we saw in 2013.

The first cracks in the bond market will most likely appear in southern European sovereign debts and European high yield securities, which will most likely mean higher volatility for global bond markets including the U.S. We are entering a period where economic growth is expanding, industrial commodity prices are rising, and manufacturing employment and wage growth are improving. All of these factors point to higher inflation; which should put downward pressure on bond prices.

For fixed-income investors, we believe the best approach in this market environment is to maintain a short-term ladder utilizing high quality municipal and corporate bonds, Treasury Inflation Protected Securities, variable rate or step up bonds, and convertible securities. Also, with early signs of inflation, gold could be a good hedge for fixed-income investors. We would avoid long-dated securities or funds with long durations.

Equity Markets

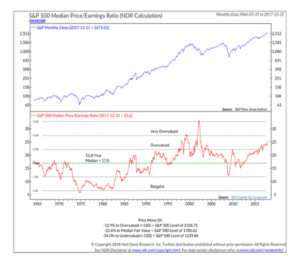

2017 was a good year for equity markets across the globe as all major markets moved higher as well as most emerging markets. 2018 looks like a continuation of last year as the global economic backdrop remains positive, which should provide a tailwind for equities. Our major concern going forward remains U.S. equity valuations as a decade of extraordinarily low interest rates have driven up asset prices on everything from art and collectibles to real estate and equities.

U.S. equities remain at the upper end of their historical valuations. High valuations with the possibility of a more volatile bond market could mean more volatility in the equity markets as well. We have now gone 14 months without even a 3% correction in the U.S. equity markets. This is highly unusual. In fact, it is unprecedented. Our expectation is that U.S. equity markets will return to normal levels of volatility over the course of 2018, which means three to four pullbacks of around 5% and perhaps a couple of pullbacks of 10% or greater. This would simply be a return to normal market behavior. Our expectation is for the general uptrend in the market to continue and with active investment management, 2018 is looking like another decent year.

As we move further into 2018, we are expecting to see some leadership shifts in the U.S. and international equity markets. We still like the financial and technology sectors. For financials, the combination of economic expansion, rising interest rates, and reduced regulations are providing a huge boost to their growth prospects. For technology, the advances in artificial intelligence and connectivity is affecting everything from cars to toasters—every device needs to be “smart.” This is a huge tailwind for all aspects of the technology sector.

Along with leadership in the financial and technology sectors, we are likely to see new emergence in natural resource sectors such as materials and energy. We have already discussed the demand for industrial metals. But it is worth noting that since the financial Crisis there has not been a significant mine opening or expansion in the world. In fact, many mines were shuttered over the past nine years. With global growth finally kicking in, we are beginning to see supply chain issues as resource demand puts pressure on available supplies. The same is true in the energy space. Outside of U.S. fracking, there has not been a significant expansion or development of an oilfield in the world. While energy supplies remain in balance, continued global economic growth will begin to put pressure on existing resources.

It is normal for the natural resource sector to go through “boom to bust” cycles. This process is driven by the nature of the industry. It takes time and a great deal of money and planning to open a new mine or oilfield. There are the regulatory and political hurdles that must be navigated as well as the start-up costs of building out necessary infrastructure. Roads, rails, ports, and warehouses/refineries need to be built and powered. Depending on the location, it can take significant time (years) and investment before new operations can produce. Typically, these projects are only considered after the global economy begins to grow. Therefore, we believe that we could be in the early stages of a boom cycle for natural resource industries, one that could last for several years. This increase in demand for natural resources should also provide an additional tailwind for Emerging and Developing economies across the globe, as well as other resource-rich countries such as Australia, Canada and the U.S.

In the equity markets, we continue to like the financial and technology sectors. We also see opportunities in the materials and energy sectors and in Emerging Markets and resource-rich countries. Finally, at the juncture of all of these areas is the Industrial sector which should also see growth and expansion going forward.

Summary

Economic growth looks to be on good footings both in the U.S. and across the globe. However, this environment will likely create inflationary pressures that will challenge the fixed-income markets. Our expectation is that the fixed-income markets will be more volatile in 2018 and that the general trend for interest rates will be for higher yields and lower bond prices. This higher volatility from the bond market will flow into the equity markets so we expect a more choppy market in 2018 when compared to 2017. However, active management of investments should provide for decent returns in equities for the coming year.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.