A Muddling Market to a Year-End Rally

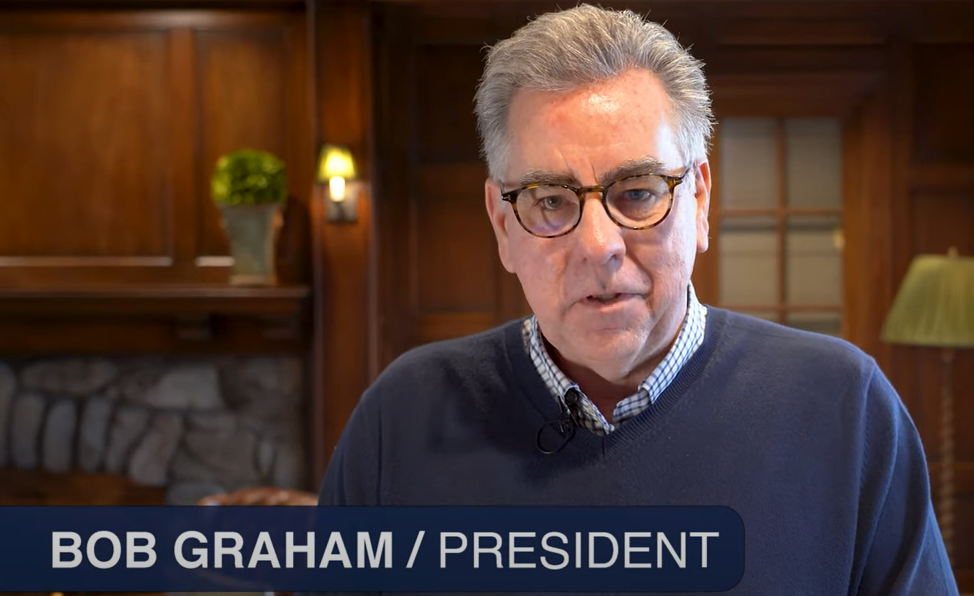

On an equal-weighted basis, the S&P 500 is negative year to date. Yet a handful of 7 or 8 stocks have driven the index higher on a cap-weighted basis. Is this reminiscent of the “Nifty Fifty” era of the 1970s where 50 stocks drove the stock market higher until their subsequent crash and underperformance through the early 1980s? Bob Graham and Liz Graham discuss and share their thoughts on portfolio management, managing risk in a narrow market, and their expectations for a year-end rally.

In honor of Veteran’s Day, we want to thank all Veterans for their service. We are very proud to have three veterans on the Riggs team. Thank you for putting the country before yourself and stepping forward to serve.