On June 24th, we sent out an Investor Alert to clients and friends regarding the Brexit vote. We noted at that time:

In a historic referendum, last night British citizens voted to leave the European Union. While there were many reasons for the “leave” vote from a rise in nationalism, frustration with the political elite, and economic policies that seemed to have little to no benefit to the populous, the outcome remains the same—the European Union continues to decline.”

In the short-term, it means we will likely see more volatility …In the longer-term, there is not much change. We have been watching a slow decline in the European Union for several years now and last night’s vote simply moves it to the front page…Over the last few weeks, we have been adding gold to our portfolios as a hedge…This should act as a counter balance to any short-term volatility…we have built up positions in U.S.-based Oil & Gas Pipelines, Real Estate Investment Trusts, and companies with similar cash flow and defensive characteristics.

Now begins the negotiation process between Britain and the various nations in Europe. While this process will be long and drawn out, at the end of the day it is unlikely that much will change in the relationship Britain has with its trading partners. To wit, Germany will still need to sell BMW’s to the British people, France will still need to sell wine to the Brits, and Spain its olive oil, and so on and so on.

What has changed is the “leave” vote brought to light the instability and the fragility of the foundation of the European Union and the rise of nationalism. There are sharp divides between Northern Europe and Southern Europe. The dominant player in Northern Europe is Germany and they desperately need to hold together the Euro and the European Union in order to maintain their export-driven economy. In stark contrast to Germany’s needs is a Southern Europe with an unemployment malaise holding steady at nearly 20%, an Italian banking system on the brink of collapse, and no relief in sight from the European Union. Europe’s deep economic issues will challenge the opportunity for growth for some time. Therefore, we believe, the best investment opportunities lay outside of Europe, specifically in the United States and the emerging world.

For U.S. investors there are some benefits that flow from the problems in Europe:

- The uncertainty in Europe has caused money to stream into safe haven investments, such as Gold and U.S. Treasury Bonds–driving yields to their lowest level in history.

- The volatility in Europe has caused the Federal Reserve to pause their efforts to normalize U.S. interest rates, which in turn is driving mortgage rates down even further. Creating another opportunity for homeowners to revisit their mortgages and see if they should refinance. For those who were thinking of buying a home, lower mortgages enhance affordability.

- The historically low mortgage rates should benefit the housing market, homebuilders, home improvement stores, and related industries.

- Low rates benefit large corporations and could encourage more stock buybacks and merger/acquisition activity. Which in turn could enhance US equity markets.

- Lastly, for anyone thinking of a European vacation, it just got a whole lot cheaper.

U.S. Economy and U.S. Fixed Income Markets

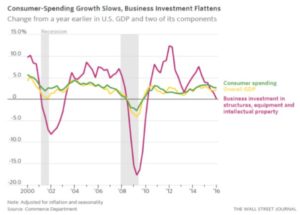

Over the past few years, U.S. economic growth has been less than stellar. However, it stands out among a sea of countries experiencing economic stagnation or decline. The U.S. economy continues to be buoyed by consumer spending. While capital expenditures (capex) have declined sharply over the past year. This decline in capex was driven entirely by the decline in oil prices and the subsequent drop off in mining activity. Now that oil prices seem to have stabilized so should capex.

While the U.S. economy plugs along, U.S. bonds have surged in popularity as investors around the world look for safe havens to park their money. This flight to safety has moved yields to their lowest point in history as you can see in this chart on the 10-Year Treasury from 1980 to today.

Low bond yields benefit government, corporations and borrowers, but they hurt savers and those on fixed incomes.

As yields are hitting all-time lows, we are also seeing the early stages of inflation creep. As the chart illustrates, the sticky inflation price index, published the Federal Reserve Banks of Atlanta and Cleveland, measures the slow-to-change components of the Consumer Price Index.

Since these items change slowly, they are harder for households to avoid and therefore over time tend to eat into their standard of living. Economically for the U.S., we may be entering an environment where inflation pressures are building and economic growth remains tepid, not exactly the “Stagflation” of the 1970’s, but still a challenging environment for many Americans.

For fixed income investors the most recent downward movement in yields has created an environment where, on a technical basis, bonds are extremely overbought. Assuming there is not another near term Brexit-like shock to the system or other exogenous event, fixed income investors should have better opportunities to add to higher yielding bonds down the road rather than buying today where your reward is so little.

We continue to recommend a laddered approach in High Quality Municipal Bonds, Investment-Grade Corporate Bonds, and Treasury Inflation Protected Bonds (TIPs). More recently, we added Gold to our portfolios as a volatility hedge. This approach will allow fixed-income investors to add bonds with higher rates once market conditions normalize.

Currently 64% of the stocks in the S&P 500 index provide a higher yield than does the U.S. 10-year Treasury bond. For income-oriented investors an equity-income approach provides a good alternative in this meager yield environment, allowing for both current income and growth in principle.

The Equity Markets

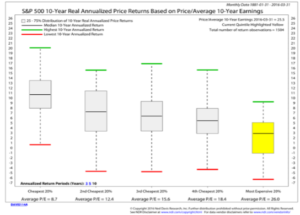

While we remain concerned about valuations in general for the stock market, over the last several weeks we have seen a marked improvement in the internal components of the U.S. stock market. The good news is the Brexit market move may have been the capitulation the market needed to move forward.

Since June 24th, we have seen a strong move in the market with broad participation. As former leaders in traditional growth, areas such as Bio-Pharma and Technology have reemerged as market leaders as well as improvement in the price action of smaller sized companies as represented by the Russell 2000. This broadening out of market participation beyond interest rate sensitive areas is a sign of improved health and breadth of the U.S. stock market.

While we continue to like Oil and Gas Pipelines and Real estate Investment Trusts which provide both income and growth, the recent improvement in more classic growth leaders bodes well for U.S. markets in the near term. Beyond the U.S. markets, we have also seen improvement in emerging markets in Asia and Latin America. In general, the backdrop for U.S. equity investors is pretty good.

Summary

We believe the best opportunities for investors remain in the U.S. and the emerging markets. With the Brexit flight to safety, U.S. bonds are expensive and being driven by troubles in Europe. Gold continues to be a good hedge during this period of volatility. Our signals have turned positive in the U.S. equity market after a year of moving sideways to down. While the market overall is still a bit expensive, individual stocks are still down significantly from the cyclical bear market that began in May, 2015. Thus, we are seeing pockets of opportunity in the U.S. equity market.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs Asset Management Company, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.