Our theme for 2015 for both the equity market and the bond market has been rising volatility and we have certainly seen that play out as the year progressed. As markets have swung up or down depending on that days headline, whether it is apprehension of a Euro crisis driven by a Greek exit or an improving jobs report here in the US that raises concern of inflation, market volatility is becoming a concern.

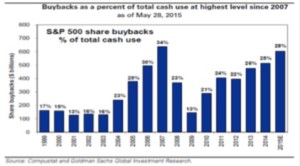

The major US equity indices ended the first half of 2015 essentially flat, with the Dow Jones Industrial Average down and the S&P 500 slightly positive. With corporate stock buy backs at their highest level since 2007, one might have expected a more robust market.

On the fixed income side, bonds are down—the Long-Term Treasury Bond Index is down -7.7% year-to-date, which is the worst start for the bond market since the Federal Reserve began its extraordinary measures to support the economy. Through this, your Riggs’ portfolios have done exceptionally well and have substantially outperformed the markets.

In our last two quarterly Riggs Reports “Volatility But Higher” and “Volatility Still With Us,” we discussed what we felt would be drivers of increased volatility in the US markets for 2015. These are: high valuations for US equity markets combined with slow economic growth, the continuing crisis in Europe, a slowing Chinese economy, and increased volatility in the bond markets. In this newsletter, we will discuss some of our current concerns, what actions we have taken to both protect your portfolios and what has allowed your portfolios to outperform. Finally, we will discuss what we will do going forward if we continue to see market deterioration.

The US Stock Market

Flashing Yellow Light – Proceed with Caution

In many ways, investing is analogous to a long road trip. There are times when the highway is clear, the sun is shining and cruising along is smooth and easy. However, there are times when the road is filled with potholes, the skies are grey and more caution is required. We believe now is a time for a bit more caution in the stock market.

As you know, we have been concerned with the valuations in the stock market for some time. The US stock market began 2015 overvalued. Long standing historical measures of valuation show a picture of continued deterioration, whether one looks at Median Price to Earnings, Median Price to Sales, Median Price to Cash Flow, or Median Price to Dividend Payout all of the major fundamental measures of value we follow show the stock market overvalued. In fact, the only valuation measures that show the stock market as reasonably priced are those that compare stock prices to bond yields. However, if bond prices continue to fall and their corresponding yields continue to rise, the stock market will come under increased pressure.

While valuation alone is not an indicator of market direction, it is an excellent indicator of market risk. The higher the valuation, the greater the risk and vulnerability to external shocks in the market. Currently, all of the major fundamental valuation measurements we follow have the market overvalued by 20% to 30% or more.

In addition to our valuation concerns, we have seen the markets continue to narrow. A narrowing market means that while the major indices continue to bounce around their highs, less and less individual stocks, industries, and sectors will participate—moving higher or even holding their own. For example, this year of the ten sectors that make up the S&P 500, only three were positive for the first half of year: Health Care, Consumer Discretionary and Telecommunication Services. These three industries represent 28.6% of the weighting in the S&P500. In other words 71.4% of the S&P 500 was down for the first half of the year.

| S&P 500 SECTOR CONTRIBUTION – 1H2015 | ||

| Sector | Weight in S & P 500

As of 12/31/2014 |

1H 2015 Return (%) |

| Health Care | 14.21 | 8.74 |

| Consumer Discretionary | 12.13 | 6.02 |

| Telecommunication Services | 2.28 | 0.61 |

| Information Technology | 19.66 | -0.02 |

| Materials | 3.17 | -0.58 |

| Financials | 16.65 | -1.31 |

| Consumer Staples | 9.80 | -2.06 |

| Industrials | 10.41 | -4.13 |

| Energy | 8.44 | -6.05 |

| Utilities | 3.24 | -12.32 |

| Source: S &P Dow Jones Indices. Price only. | ||

| Ned Davis Research Group | ||

As the markets have narrowed, we have also narrowed the focus of your portfolios. Through this process, we have pushed out positions that were not performing thus leaving us most heavily focused in areas that are outperforming the markets. When investing, what you DO NOT own is just as important, as what you DO own.

Along with the narrowing of the markets, we have seen previous leading segments of the market begin to roll over. For example, the Dow jones Transportation Average has recently rolled over and has been heading even lower for several months now. Along with this, we have seen the interest-rate-sensitive Dow Jones Utility Average and the Dow Jones REIT Average break down and head lower. This is not the way healthy markets behave.

Therefore, with stock market valuations extended and the market itself struggling we believe at bit of caution is a good idea. Moving forward, we will closely monitor the internals of the market. If we see signs of market improvement then we will expand our holdings, focusing on those areas of the market that are still growing and providing above average market returns. However, if the stock market continues to deteriorate we will further expand our cash reserves and look to buy new positions at lower prices on a market pull back.

As we are managing through this period, your portfolios continue to do well and are well positioned to take advantage of opportunities.

Fixed Income Markets

As we have discussed in our previous two quarterly newsletters, the bond market is stuck between two competing forces. One, the Federal Reserve’s desire to move towards normalization and two, the economic/political issues flowing out of Europe paired with the slowing of the Chinese economy. Based on the actions within the treasury markets over the past few months, it looks like the Federal Reserve’s move towards initiating normalization is having a greater influence on the bond markets as interest rates have generally moved higher and bond prices lower.

Currently short-term interest rates are approximately 0.1%. According to the average of voting Federal Reserve Governors, expectations are that short-term rates should reach 1.75% by the end of 2016. If the Federal Reserve is able to accomplish this, it would represent a significant shift downward in bond values and a significant shift upward in yields across all maturities. Currently, the Ten Year Treasury Bond yields 2.3% while the Thirty Year Treasury Bond yields 3.1%. A normalization of rates could push yields above 4% and 5%, respectively. As the table below illustrates, this would have a significant effect on bond pricing.

| Potential Interest Rate |

Potential Price Movement |

||

| Increase of… | 2-Year

Treasury |

10-Year

Treasury |

30-Year

Treasury |

| 0.25% | -0.48% | -2.23% | -4.92% |

| 0.50% | -0.96% | -4.49% | -9.84% |

| 1.00% | -1.92% | -8.93% | -19.68% |

As we have discussed in the past, the makeup of the bond market as well as the bond investor has changed. It is much more institutional today than ever before. Many firms use mutual funds and exchange traded funds to manage their fixed income positions rather than holding individual bonds. In many cases, these holdings are treated as trading tools rather than investments. Today, liquidity in the bond market is roughly 10% of what it was eight years ago which makes it more susceptible to outside market shocks.

If there is a misstep by the Federal Reserve or an economic report that creates an inflation scare, we could see many institutions head for the exits at the same time. If this were to occur, we could see exaggerated moves in the bond markets. Anything that disrupts the bond market would have ripple effects that reverberate through the stock markets.

Therefore, we remain conservative in our fixed income approach and look for opportunities to buy bonds at cheaper prices down the road.

Greece

With the recent events in Greece once again hitting the headlines, I thought I would reprint an excerpt from our January 2015 Riggs report.

There are three areas that are likely to have the greatest influence in 2015—1) How Europe manages through their economic challenges; … Europe is facing many headwinds today—from an aging workforce in Northern Europe, to double-digit unemployment throughout Southern Europe, and, most important in the short term, the inability of European leaders to solve their credit crisis that is now entering its eighth year. Sitting at the heart of each of these issues is the Euro.

The economic crisis is now moving from the streets to the capitals as political groups once considered “fringe” gain political power…where more extremist national parties in one country give rise to more extremist national parties in another country. If this continues, then we could see the ongoing economic crises turn into a full-blown political crisis. The Euro was originally a French concept with a thought to bind the European heartland together so tightly economically that another European war would be impossible. As more nationalist parties rise to power, that concept may be placed under pressure.

The European economy will likely remain in the doldrums and represent a drag on the global economy. While the European central bank is promising a U.S.-style form of Quantitative Easing Program, there are significant structural differences between Europe and the U.S. that will likely make Europe’s eventual attempt less successful. As the issues facing Europe begin to express themselves in the political arena, we could see European-driven volatility occur in the U.S. markets similar to what we saw in 2011 and 2012.

The issues in Europe have now moved beyond economics and are now political. While Greece as an economic entity is not significant, it is an example of many of the issues facing the developed world and the global economy today. How do governments pay for the social pact they have made with their citizens? Whether it is a Greece, Puerto Rico, Detroit or an Illinois bankrupt pension system, these issues will be with us for an extended period.

Summary

In summary, we have turned more cautious towards both the Stock Market and the Bond Markets. The increase in volatility and the deterioration in the markets have risen to a point of concern. As this cycle proceeds and if risks continue to rise, we will continue to reduce exposure and increase our reserves so that we can reinvest at lower prices. Your portfolios are doing well and we will continue working proactively to grow and protect your wealth through this volatile period.

“Wealth is created by the ability to recognize opportunity and the willingness to act upon it and the ability to recognize risk and the willingness to reduce exposure.”

*********

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs Asset Management Company, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.