Impact of Israel-Hamas War on Investment Markets

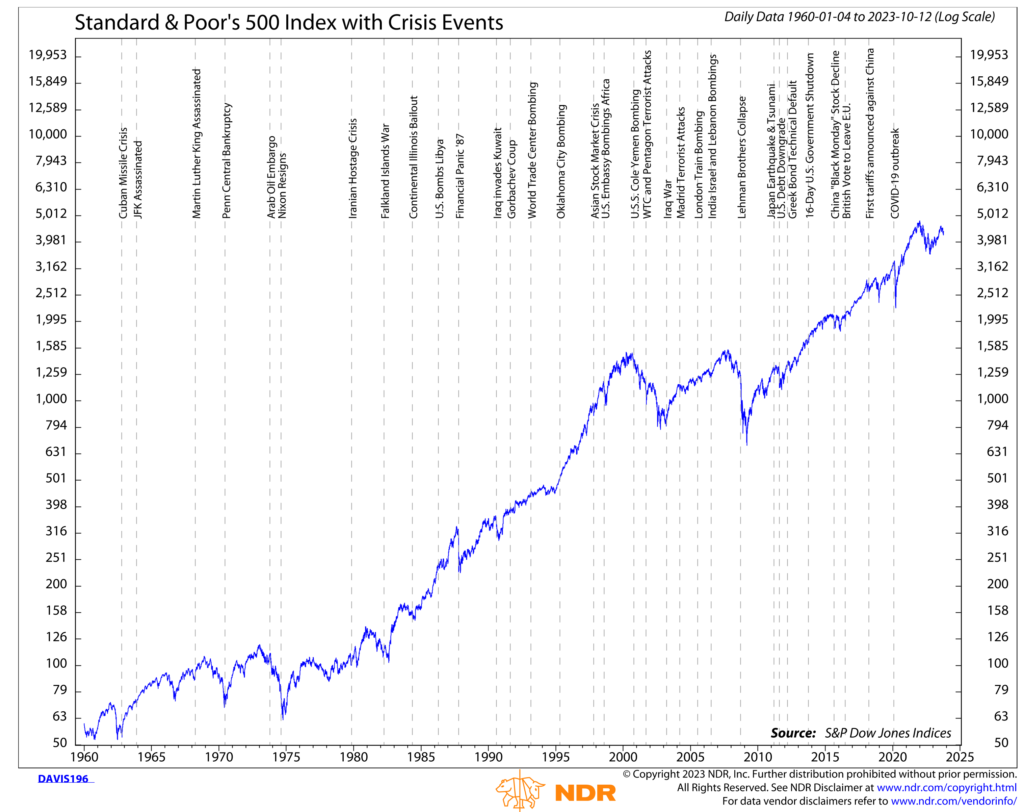

It is a week since the horrific attack by Hamas on Israel. You may wonder what the attack’s impact and subsequent escalation to an all-out war will have on the investment markets. Typically, the initial market reaction is a decline, but losses are usually recouped within a month. In reviewing the market reaction to crisis events over the last 100+ years, the S&P 500 Index has declined a median of 3.0% during the crisis period but has gained a median of 4.7% a month later. As you can see from the chart below, the short-term pullback generally yields to a higher market.

While that is the general trend, we must also consider our current economic environment.

Before the attack, the Federal Reserve had indicated they would likely raise short-term interest rates one more time before the end of the year. Then employment growth numbers came in stronger, inflation numbers were a little higher, and the market and investors worried the Federal Reserve might have to keep hiking rates.

On October 3rd, investor sentiment hit the “extreme fear” level as the yield on the 10-year Treasury rose to 4.81%–a level we have not seen since 2007. At the same time, chaos in Washington led to the dismissal of Representative Kevin McCarthy as Speaker of the House and the likelihood that a US Government shutdown loomed in November. And four days later Hamas attacked Israel.

But it appears that investor fear and spike in US Treasury yields reached their crescendo and have begun to roll over, and the S&P 500 has moved slightly higher. Why? Because the dysfunction in Washington followed by the invasion of Israel, led the market to believe that the Federal Reserve is likely done with raising interest rates this cycle.

While we remain cautious given the geopolitical environment, we see signs that the market is bottoming, and a year-end rally may be in the making. Historically, when the Federal Reserve pauses or ends its tightening cycle, it has been a positive for stocks. The fact that the S&P 500 has managed to move higher this week in the face of so much negative news is another signal that the market may be bottoming.

We have one caveat to our market bottoming thesis—US Treasuries. The U.S. budget deficit, which exploded during the pandemic, is projected to keep rising over the coming decade. An increase in defense spending (to fortify the U.S. and our Allies’ needs) without cuts in other government outlays (which are unlikely in an election year) will only make those projections higher, putting upward pressure on bond yields and net interest payments. Higher U.S. Treasury yields will entice investors to pull money from the stock market and buy U.S. Treasuries. If Treasury yields move higher, stocks will likely move lower. We are not seeing this right now, but we are keeping a close eye out for any change in yield direction.

To summarize, crisis events have little long-term effect on the equity market, and we expect this will be no different. The market is in a bottoming process, and the market’s resiliency this week indicates that we may have a year-end rally in the making. We just need to keep an eye on Treasury yields. If they were to reverse course and move higher, that would put pressure on the stock market. But for now, we see signs of good buying opportunities in the stock market.