When will we see a market correction? That seems to be the question we are getting most frequently from clients and others. For now, the answer is “not yet” as our indicators are still mildly positive with continued demand for stocks and low volatility in the market. We expect the stock market to continue to drift higher and the bond market to remain relatively benign through the summer.

As we look ahead, we do have some concerns looming on the horizon. The investment markets do not like uncertainty. They typically respond to an uncertain environment by pulling back. We can see ahead of us uncertainty associated with:

- U.S. Mid-Term elections;

- The Federal Reserve ending their Large Asset Purchase Program; and

- Geopolitical unrest.

The stock market could view any one of those issues (or a myriad of others) as a reason to hit the pause button on its forward momentum. Should the markets pullback, we would view that as an opportunity to buy into the market at discounted pricing. Our long term view of the stock market is quite positive but it would be nice to add to our equity positions at lower prices. With our bond investments, we believe the road may be choppy for a while so we will continue to be conservative in our approach.

So let’s delve further into what we are seeing in the economy and investment markets.

U.S. Economy: Mother Nature Gets Our Attention

We have seen economic activity pick up since the dismal performance of the U.S. economy in the first quarter of this year where the economy actually declined by -2.9%. Most economists viewed this as an anomaly and a one-off bad winter weather related event. We expect there is some truth to the weather argument as it is hard to get customers in to buy a car when it is 5 degrees below zero but the severity of the economic pullback was disturbing for an economy six years into a recovery.

In our last Riggs Report, we discussed the winter vortex and the expected bounce back this past spring: “our expectations are for a generally improving economic back drop as the year progresses. We would not be surprised to see an increase in economic activity through the spring and into early summer as the weather improves.” To a great extent, that is what we have seen.

While bad weather may have been the headline, the real story was the fragility of the U.S. economy. Even after six years of recovery, something as innocuous as bad weather sent economic growth on a backward slide. This speaks to how careful the Federal Reserve must be as they try to normalize their support of the U.S. economy. Any quick or unexpected moves could lead to sharp movements to the downside.

Fixed Income Markets: Change is Never Easy

In an effort to support the U.S. economy, fuel economic growth, and to move our economy out of the recession, the Federal Reserve has taken the starring role. One of the tools the Federal Reserve used to fuel growth was the Large Scale Asset Purchase Program (LSAPP). Through LSAPP, the Federal Reserve began pumping $85 Billion a month into the U.S. economy through its purchase of Mortgage-Backed Securities and Treasuries. As our economy strengthened, the Federal Reserve announced an exit strategy where they would reduce their monthly purchases and eventually end the monthly purchases altogether. That end date is expected for this October.

Another tool the Federal Reserve has used to spur economic growth is the Zero Interest Rate Policy (ZIRP), where the Federal Reserve has essentially kept short term interest rates at zero for six years now. These policies in combination over the past six years have had the effect of driving up prices of both high quality bonds as well as more speculative fixed income investments. The Federal Reserve continues to debate when to end ZIRP and begin to move short term interest rates higher. It has been expected that they would look to do that in 2015.

As the Federal Reserve ends key policies that have been supportive of the economy, it is clear that the fixed income markets will go through a significant transition period. Typically transition periods are marked by increased volatility and market dislocations. While these periods can be difficult they do provide opportunity for the prepared investor.

For now, we believe fixed-income investors should remain relatively conservative in their approach to the markets. It would not surprise us to see a significant increase in bond market volatility as the Federal Reserve tries to move away from its current policies and allow the markets to normalize. Under their current guidance, this process could take a couple of years. We will look to position your fixed income portfolios to both weather the increased volatility and to take advantage of the opportunities it creates.

On a longer term basis, the risk remains toward gradually rising interest rates and lower bond prices.

Stock Market: Are We There Yet?

Five years into this current bull market cycle without a correction of 20% or more is relatively unusual. So it is not surprising that the rhetoric is escalating on when we may see a market correction. Knowing when to sell is probably the hardest decision an investor will make. Every investment requires an exit strategy and for our part, we like to rely on our research indicators to give us a more disciplined approach to the sell side. Right now our indicators are leaning toward a continuation of this bull market cycle through the summer. So to answer the original question—are we there yet? The answer is “no, not yet.”

We do have a few concerns with the U.S. stock market though. First, it has been a long time since we saw the stock market correct. Markets do not move straight up or down but rather in a stair step pattern where you move up, then pull back, then move up again. In the current market cycle, the S&P 500 has advanced for about three years without a 10% correction and for more than five years without a 20% setback. So a pullback this year would not be surprising.

We are beginning to see signs that valuation is getting high and investor sentiment soft. Further, there are two calendar events that could be an excuse or a catalyst for a market correction—mid-term elections and the end of LSAPP. Both of those events are scheduled in the fall.

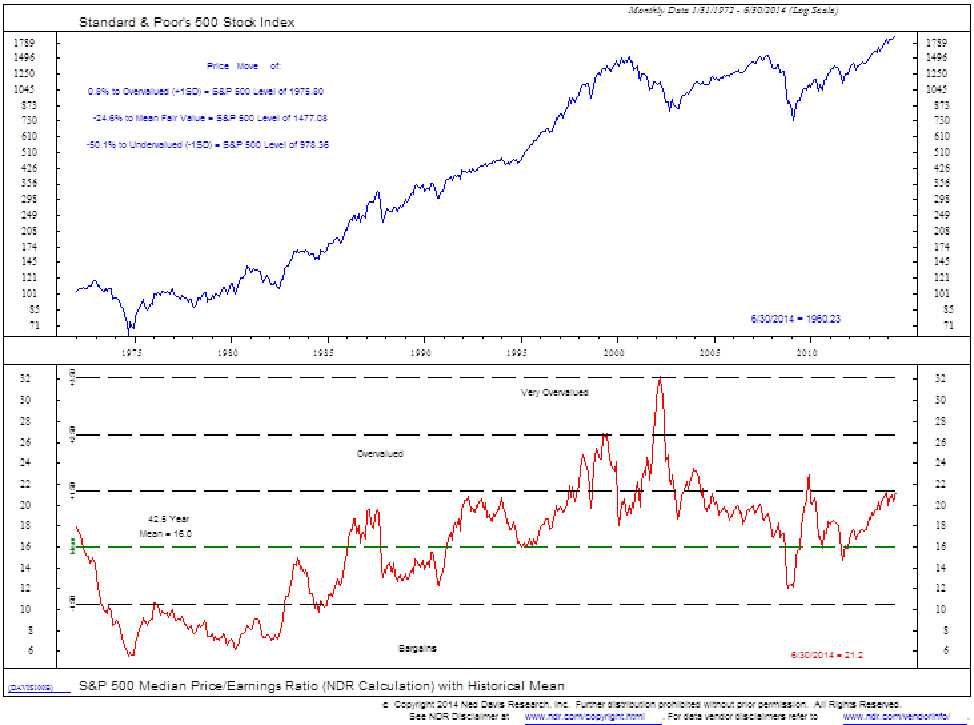

When we look at our valuation matrices, we find that valuations are extended and in many cases exceeding previous high valuation levels. For example, the Median Price to Earnings Ratio for the S&P 500 is now above its 2007 valuation levels (and higher today than most of its history excluding the Dot.com/Tech bubble of the late 90’s early 2000’s).

We see a similar picture when we compare the S&P 500 to its sales. As the chart to the right shows the S&P 500 is now selling at its highest level in history when compared to its own sales.

We see a similar picture when we compare the S&P 500 to its sales. As the chart to the right shows the S&P 500 is now selling at its highest level in history when compared to its own sales.

High valuation by itself does not mean that the markets will correct. However, when we do hit the inevitable bump in the road, high valuations can affect the magnitude of the decline.

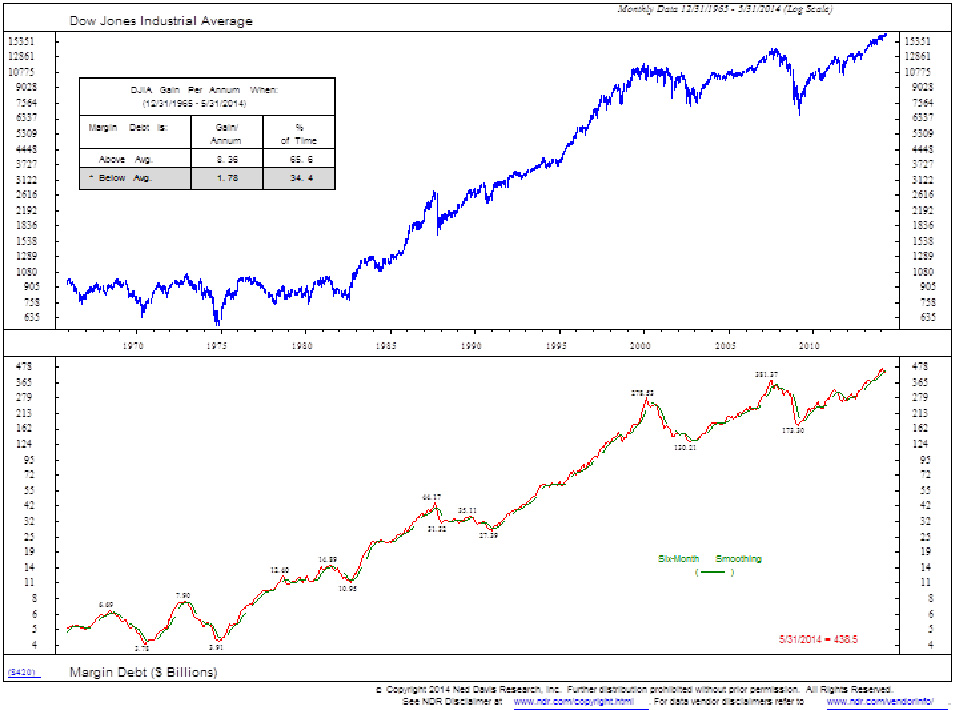

In our 2014 Investment Outlook we stated … Valuation can also be considered a form of sentiment indicator, as investors become more confident with a market they put more and more money into it until most investors are fully invested and there is no one left to buy. This tends to be the point of highest enthusiasm. One way to measure sentiment is to look at the amount of money held in money market accounts…money markets as a percentage of the equity market are at their lowest level since 2000. Since then the available cash on the sidelines has continued to decline and margin debt has continued to rise. Margin debt as a percentage of GDP has now surpassed both its 2000 and 2007 peaks.

So over the course of the last six months both valuations and investors sentiment has become further stretched. So while our internal indicators remain positive the risk level continues to rise.

While high levels of valuation and sentiment are of concern they are not necessarily drivers of a market correction, typically there needs to be a catalyst. So, what are some of the risks we see? There is a historic pattern in the markets during mid-term election years. During mid-term election years, the market tends to do well during the first phase of the year, as it has this year. Then as the rhetoric escalates going into the election, the market tends to pull back. Once the elections are done and everyone has a better sense of the political landscape, the markets tend to use that greater certainty to rally into year end. So this is a historical trend to watch.

As we discussed in the Fixed Income Section, the Federal Reserve is phasing out the Large Scale Asset Purchase Program and that Program is set to end in October. Since 2009 every significant correction in the stock market has coincided with the ending of one of the Federal Reserve’s Quantitative Easing programs.

With rising tensions around the world, geopolitical risk is elevated. For example, the Middle East continues to be problematic. The modern global economy runs on energy whether it is for global trade or local commerce. If it flies, floats, or motors along the road it requires oil and the heart of the global oil infrastructure remains firmly anchored in the Middle East. Therefore, a serious disruption of the flow of oil out of the Middle East can negatively affect energy prices, the global economy, and the investment markets. Similarly tensions with Russia over the Ukraine or our ongoing issues with China could all lead to market disruptions. Often the markets can get blindsided by a geopolitical event so the fact that there is a rising level of risk throughout the world does make us cautious.

With these items on our radar screen, we have concerns for the stock market and we believe the risk level is rising. For now our internal indicators remain intact and the stock market should continue to drift higher through the summer. As we look forward, our view is less sanguine.

With that as the backdrop, our strategy is to let your portfolios continue to grow while the markets remain in gear. We have already taken some defensive positions and if we see our technical and fundamental signals begin to turn, we will move quickly to a higher weighting of cash and defensive holdings. We will use cash and defensive investments to preserve principal during any correction and use a correction in the equity markets as an opportunity to invest at discounted prices and allow holdings to appreciate going into a year-end rally.

We believe that the markets are in transition, with U.S. equity markets moving into a long-term (a decade or more) bull market and with U.S. fixed income markets moving into a long term bear market. As a result, our model allocation has transitioned from a balance of equities and fixed income to a higher orientation to equities. We believe that the equity markets will continue to benefit from economic tailwinds but the fixed income markets will continue to face headwinds.