Modern Day Bank Run and Implications for Investors

We have had a lot of conversations with clients and friends over the last two weeks asking us for our insight into what is going on with banks. This is a complex and fast-moving situation, but at the core is a concern for the safety of bank deposits.

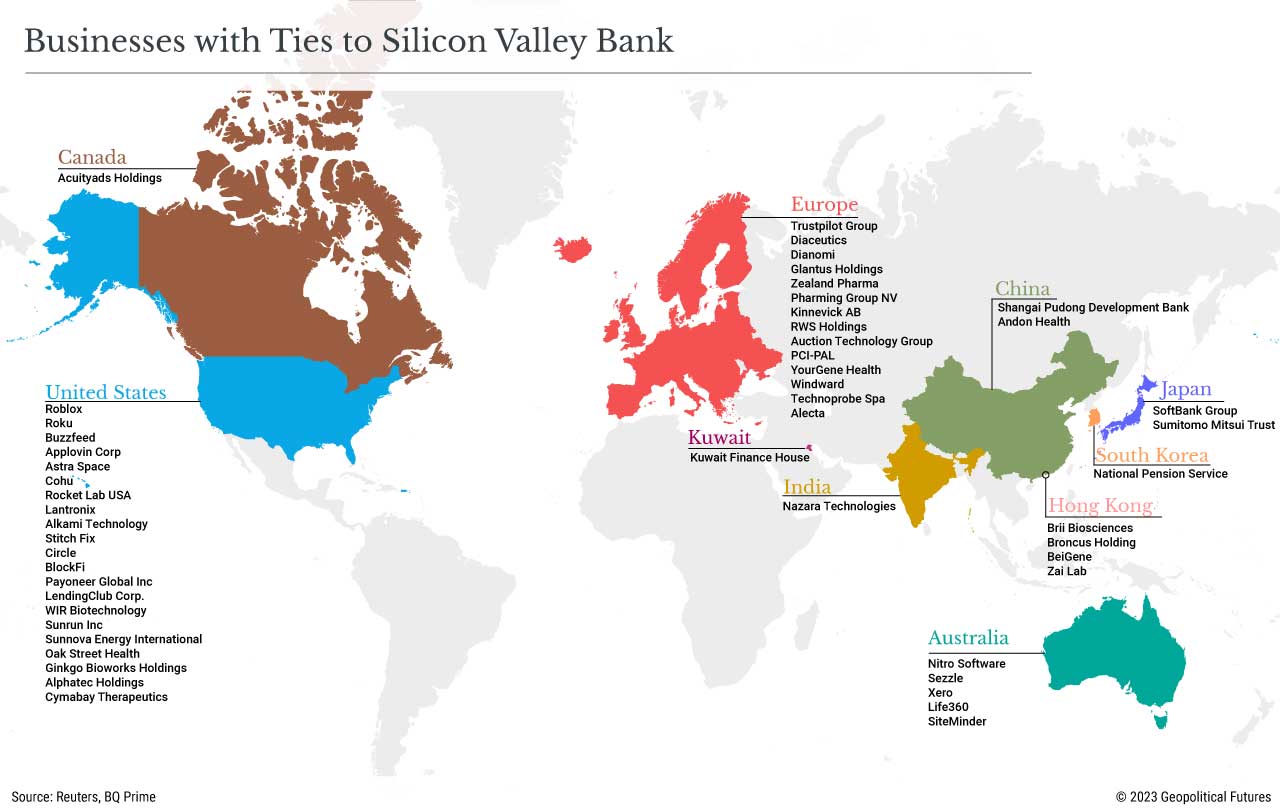

On Thursday, March 9th, Silicon Valley Bank (SVB)—a bank that serves start-up businesses, technology companies, venture capitalists, and others—experienced a run on its bank fueled by social media and text messages. Customers of SVB tried to withdraw $42 Billion in deposits in a single day. In an age of real-time communication tools such as Twitter and the ability to electronically move money instantly via an app on your mobile phone—SVB experienced a modern-day run on the bank. In turn, every bank in the world learned that deposits are not “sticky” and flee with a swipe.

The use of social media and texting allowed the loss of confidence in the stability of SVB to spread like wildfire. But the worse news was to come. As you know, insurance on bank deposits through the Federal Depository Insurance Corporation (FDIC) is limited to $250,000 per bank per account ownership. However, many of SVB’s customers, which largely included venture capital firms, small technology companies, and entrepreneurs, had uninsured deposits at the time the bank failed. 2022 S&P Global Market Intelligence data showed 94% of SVB’s depositors were above the $250,000 FDIC limit.

Over the weekend of March 11/12th, as business customers of SVB scrambled to line up funding sources to meet payroll and day-to-day operations with their deposits at SVB in limbo, federal regulators announced that they had:

- Taken control of another bank–Signature Bank of New York;

- Unveiled a new emergency program to make depositors whole at both banks (SVB and Signature) even if their deposits exceeded $250,000; and

- Created a new lending program for banks so they can receive par value on their U.S. Treasury bond holdings should the banks need cash to cover withdrawals.

All measures were taken to provide confidence and stability to the U.S. financial sector both in the U.S. and abroad, as SVB’s failure was wide-reaching.

Over this past weekend, Credit Suisse—Switzerland’s second largest bank founded in 1856—will no longer exist as a standalone bank. Credit Suisse had been under financial strain for some time with concerns that it would fail. A deal was brokered for UBS Financial Services to absorb Credit Suisse Bank to prevent it from going under and to stem the contagion of more bank failures. Further, over the weekend, Central Bankers from around the world and the U.S. Federal Reserve, in a coordinated fashion, increased the frequency of U.S. Dollar swap lines from weekly to daily to ensure liquidity and smooth operations between the network of central banks around the world and prevent liquidity from seizing.

So, what is the fallout from the last two weeks?

First, our expectation is that the FDIC will increase their insurance levels. The $250,000 level is arbitrary and low especially given the inflationary environment we have been in since it was increased in 2008. For example, brokerage and investment accounts have much higher insurance protections. Further, for business banking and payroll deposits, the $250,000 level will consistently lead to uninsured deposits. That weakness was magnified with the SVB failure and will likely be addressed.

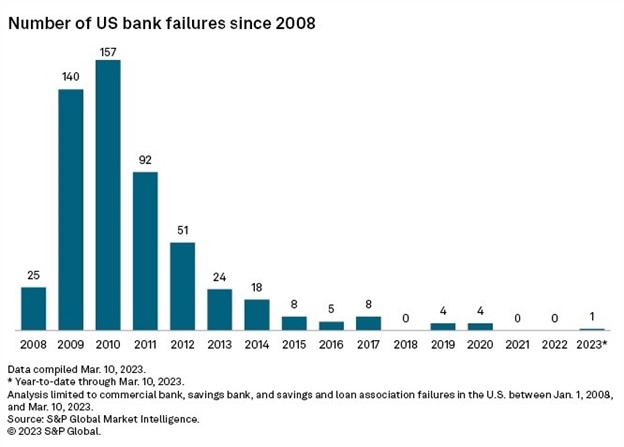

Second, we are likely to see regulatory changes for mid-size and smaller banks. The U.S. banking system is a bifurcated system. There are “too big to fail” banks such as JP Morgan, Citigroup, Bank of America, and others. Those banks are subject to higher levels of regulatory oversight and financial stress tests. The second group is mid-size and small community banks. These banks are the backbone of small businesses. These are the banks that lend money to your favorite pizza shop and support your local Chambers of Commerce. They are a critical component of the U.S. economy. SVB and Signature Bank fell into the second category. As a result of their failures, smaller-sized banks are likely to face greater scrutiny from regulators as well as higher capital requirements. This will tighten lending from these banks and slow U.S. economic growth. The lessons learned in 2008 were effective but, perhaps, need to be fine-tuned.

The Federal Reserve and Central Banks from around the world have stepped up once again to move swiftly to shore up confidence in the global financial system.

From an investment perspective, this week the Federal Reserve has their March Federal Open Market Committee (FOMC) meeting, where they will discuss economic conditions. Before the SVB and Signature Bank failures, the Federal Reserve was largely expected to increase short-term interest rates by another 0.50%. But after the events of the last two weeks, where the fault lines of economic stress have become clearly visible, the market is now expecting that the Federal Reserve will either increase by 0.25% and then pause or simply pause. Should the Federal Reserve do the unexpected and raise short-term rates by 0.50%, we expect the stock market to sell off sharply. But if the Federal Reserve is more conciliatory in its approach, the market should move higher. We continue to favor companies with strong balance sheets, tailwinds from fiscal infrastructure spending programs and demographics, U.S. Treasuries and T-Bills, and the use of money market funds for cash. The market is nearing an inflection point, and assuming the Federal Reserve does not make a policy error, our expectation is for a bit of a relief rally.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs Asset Management Company, Inc. (“Riggs”), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure Brochure discussing our advisory services and fees is available upon request.

Please Note: If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Riggs shall continue to rely on the accuracy of information that you have provided.