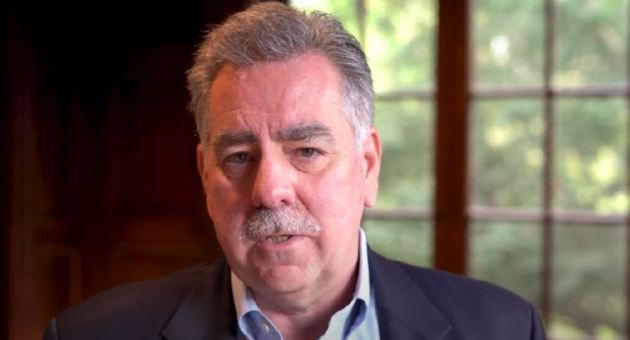

Robert J. Graham Interview with the Mitchell Institute

Recently, our Founder, Robert J. Graham, was invited onto the Aerospace Advantage Podcast produced by The Mitchell Institute. We wanted to share this interview with our clients and friends as it speaks to Bob’s service in protecting the United States and is an example of the selfless courage of a young fighter pilot. Here is a bit of Bob’s story in his own words.

https://mitchellaerospacepower.org/episode-139-flying-and-fighting-against-the-odds-a-cold-war-perspective/

* * *

In Episode 139 …