The first quarter of 2017 saw a marked rise in investor optimism as expectations of an improving economy drove U.S. markets higher. The sectors most impacted by an increase in U.S. regulations and a decrease in fiscal spending over the last eight years—financials, industrials, and materials—were the equity market rally leaders following the November U.S. Presidential election. Riggs’ clients were well-positioned for this rally. Not surprisingly, after such a quick run up in the U.S. equity markets, the markets are taking a breather as investors digest the challenges to making quick changes to U.S. policies—whether it is reforming healthcare, restructuring the U.S. Tax Code, or passing a major infrastructure revitalization program. Our expectation is that this pause in U.S. equity markets will be relatively short and the pullback somewhat shallow.

While the U.S. equity markets take a short pause, we are seeing some good opportunities in international markets. Since the financial crisis in 2008, the U.S. markets have rebounded significantly while European and Asian markets have lagged behind plagued with slowing to negative growth. They now seem to have stabilized and growth is picking up. We have begun to build positions in the international markets, specifically in Europe and Asia. We expect this will provide you with good opportunities today and going forward.

On the bond side, with economic growth on the rise, bond investors must worry about increasing inflation and rising interest rates outpacing bond returns. With an improving economy, the Federal Reserve is methodically raising short term interest rates. As interest rates rise, this will put pressure on existing bond prices as investors will find new issued bonds with higher rates more attractive for purchase than bonds issued in the lower rate environment. As a result, existing bond prices should decline as rates move higher. The Federal Reserve has also indicated a desire to reduce their balance sheet.

The Federal Reserve has served as a primary buyer of U.S. fixed income securities since 2008 and with improving economic growth, it is looking to slowly back away and let other investors fill the gap. This will be a very tricky balancing act and the risk to investors is that the Federal Reserve will tighten and exit too quickly. Any stumble by the Federal Reserve as they move to normalize will negatively impact fixed income and equity markets.

Economic Growth Improving

As we noted above, following the U.S. Presidential Election the markets took off—part relief rally as the election was behind us and part in anticipation of a pro-business presidency. This rally was aided by the fact that Republicans retained control of the House and hung on to their majority in the Senate. Unfortunately, something happened on the road to political harmony and that something is the “political process.” As the old joke goes, “Congress can’t pass a light bill in six months,” much less reform healthcare, restructure the U.S. tax code, and pass a major infrastructure revitalization program.

The political process takes time. Congress has 535 voting members, 435 Representatives and 100 Senators. Each one of these individuals has their own individual beliefs, thoughts, and opinions and must answer to their constituents. Therefore, even when one party controls both houses of Congress and the White House, the process is a messy one. This was true for President Obama and it will certainly be true for President Trump.

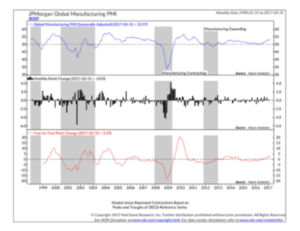

Outside of Washington, D.C., the U.S. and global economies are showing signs of improving economic growth. As the chart to the right illustrates, the Global Purchasing Managers Index (PMI) (top clip) is accelerating. The PMIs are based on monthly surveys—which provide an advance indication of what is really happening in the economy by tracking changes in production, new orders, inventories, employment, and prices. When the PMI is above 50 it means the global economy is growing; when it is below 50 it means the global economy is contracting. Today, the global PMI is at the highest level in six years. This bodes well for global growth.

Therefore, we remain optimistic for continued growth in the U.S. and global economies, which should support equity markets. However, this growth will most likely put pressure on bond markets.

Economy, Interest Rates and Bonds

Currently our research indicates that U.S. real economic growth should be around 2.8% for 2017. This is a significant improvement over what we have seen in the past six years where economic growth has averaged about 2%. This improvement in growth is being driven by capital expenditures and an expectation of some fiscal stimulus coming out of Washington. Globally we are also seeing an improvement in economic growth with global GDP expected to expand to 3.4%. This is lead primarily by improving economies in Europe and Asia.

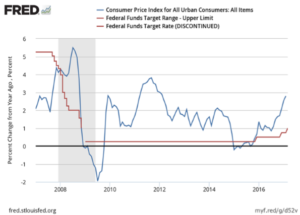

With this improvement in economic growth, we have also seen a pickup in inflation pressures and rising interest rates. As the chart illustrates, inflation as measured by the Consumer Price Index had been in a general downtrend since 2008, while the Federal Reserve had kept short-term interest rates at about zero since then, more recently we have seen inflation pick up and the Federal Reserve is moving to gradually increase interest rates along with this rise in inflation.

While our base case is for a generally improving economic backdrop, some things could cause us to rethink this scenario:

First, if the Federal Reserve becomes too concerned about inflation and they raise interest rates too quickly this could cause the U.S. economy to stall. However, our expectation is that the Federal Reserve will be cautious in their approach to raising interest rates for fear of negatively affecting the economy and therefore, if anything, will remain relatively accommodative even if inflation accelerates a bit. In other words, the Federal Reserve will maintain policies that support and encourage economic growth.

Second, one of the major drivers of economic growth for the U.S. over the past seven years has been the rise in automobile sales. Many of these sales were a product of pent up demand from the recession in 2008 – 2009. That pent up demand has now been satisfied. That, in combination with higher interest rates on auto loans, means that auto sales have likely peaked for this cycle and will no longer be a driver of excess economic growth. Therefore, we will need to see capital expenditures both public and private expand in order to offset the slowdown in auto sales. This means more spending on infrastructure, smart energy, and telecommunications systems.

Third, a failure in Washington to deliver on needed fiscal reforms and some stimulus could cause the economy to stall. Our expectation is that the political process will be messy with several starts and stops; but in the end, we will see some tax reform, an infrastructure-spending package, and perhaps health care reform. These along with easing of the regulatory burden on businesses should provide a powerful boost to the U.S. economy.If these things do not occur then we could see the U.S. economy slow and, perhaps, even enter a recession, in which case the entire global economy could suffer. However, for now it looks like global growth is improving.

The improvement in economic growth, as noted above, is not just a U.S. phenomenon, but is occurring across the globe, as is the general rise in interest rates. As the chart illustrates, since interest rates bottomed last July, U.S. and German 10-Year yields have largely risen together. A similar picture can be seen in developed markets around the world; interest rates are rising.Therefore, we are upbeat on global growth but remain cautious towards the bond market. Our expectation is that interest rates will gradually move higher, putting downward pressure on bond prices.For fixed income investors we believe the best approach in this market environment is to maintain a short-term ladder utilizing high quality municipal and corporate bonds, Treasury Inflation Protected securities, variable rate or step up bonds, and, on a tactical basis, convertible securities and high yield bonds.

The improvement in economic growth, as noted above, is not just a U.S. phenomenon, but is occurring across the globe, as is the general rise in interest rates. As the chart illustrates, since interest rates bottomed last July, U.S. and German 10-Year yields have largely risen together. A similar picture can be seen in developed markets around the world; interest rates are rising.Therefore, we are upbeat on global growth but remain cautious towards the bond market. Our expectation is that interest rates will gradually move higher, putting downward pressure on bond prices.For fixed income investors we believe the best approach in this market environment is to maintain a short-term ladder utilizing high quality municipal and corporate bonds, Treasury Inflation Protected securities, variable rate or step up bonds, and, on a tactical basis, convertible securities and high yield bonds.

Equity Markets

The equity markets have had a good start to 2017 both in the U.S. and on a global basis. The S&P 500 rose by 5.5% this quarter, which is the best start for a year since 2013. More importantly perhaps, is that MSCI EAFE (Europe, Australasia and Far East) was up 4.7%. The EAFE includes all the major markets in Europe and Asia. Since the financial crisis of 2008 – 2009, these markets have yet to recover.As discussed above, global growth is improving. Further, it now looks like markets in Europe and in Asia may be beginning to participate in—if not lead—a global equity market advance. One of the reasons we could see markets in Europe and Asia outperform the U.S. markets, is valuation.As the chart on the right illustrates, over time European and U.S. markets tend to trade within comparatively normal valuation ranges both on a relative and absolute basis. Today, the U.S. market is relatively and absolutely overvalued; while the European markets are relatively and absolutely undervalued.This difference in valuation plus the improvement in global growth should lead to acceleration in international equity markets. For equity investors, we believe that now is a good time to increase international exposure. We particularly like the European and Asian markets.Here in the United States, the markets have had a very nice rally since the Presidential Election in November and investor sentiment has become extremely bullish. Typically, when investor sentiment becomes this bullish, the equity markets pull back or pause in their upward bias. Further, this rally has been led by very pro-cyclical segments of our economy such as Financials, Industrials and Materials. While on a short-term basis, these areas may have moved up a little too far too quickly, they should be the primary beneficiaries of a more pro-growth/pro-business environment in Washington. Therefore, while we could see a pause or shallow pull back in US equity markets, we believe the general trend remains positive and pullbacks represent an opportunity to buy or reallocate to equities.

Final Thoughts

Riggs’ clients have benefited from the U.S. equity market rally following the U.S. Presidential Election. Since the election, we have seen a transition in U.S. sector leadership toward pro-growth cyclical sectors. As global growth improves, these sectors should continue to perform well and would be further enhanced by pro-growth policies coming out of Washington, D.C. However, the recent run up in the U.S. stock market has been a quick one and we are not surprised to see the market take a break. Our expectation is that any pullback in U.S. equity markets should be relatively shallow.Over the last 8 years, we saw the best investment opportunities primarily in the U.S. With the stabilization and increase in growth internationally, we are now starting to see opportunities overseas—primarily in Europe and Asia. We have increased our international positions and this is likely to be a developing theme should global growth continue. While a tailwind for equities, global growth serves as a headwind to bond investors with rising inflation and interest rates impacting returns. We remain cautious in our approach to fixed-income investing.While we see good opportunities in the investment markets, we also see risks. Those risks are largely centered in Washington. As the Federal Reserve moves toward a more normalized approach, the risk is that they tighten too quickly. To date, their approach has been to err on the side of being too slow but any misstep in their approach will impact both equity and fixed income markets. Finally, should Congress not deliver the pro-growth agenda that investors have expected, that loss of investor confidence will get priced into the equity markets. Thus, this is not a time for investors to be sanguine toward the markets. The investment landscape is riddled with potholes and an active approach is needed to mitigate the impact of these and other risks to portfolios.

* * *

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.