The recent dip in the markets has many investors nervous; this is understandable given current headlines from dysfunction in Washington, policy shifts by the Federal Reserve and geopolitical risk on the Korean peninsula. However, at least so far this is looking like a normal seasonal pullback in the equity markets.

In our most recent Riggs Report, we discussed our outlook for the equity markets for the second half of 2017, in that Report we stated:

The first half of 2017 has been good for equity investors … A good first half of the year bodes well for the second half. Since 1950 when the first half of the year has been positive, the second half is also positive 78% of the time, so statistically, those are good odds. Our expectations are for the equity markets to generally trend higher throughout the rest of the year—but, perhaps, with the typical “summer swoon.

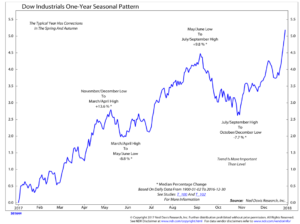

The chart below is a composite of the annual pattern of the Dow Jones Industrial Average since 1900. As you can see, the equity markets tend to move in seasonal patterns—rising in late winter to early spring, then stalling or pulling back into early summer, rising again into mid to late summer with a pull back into the fall and then a rally into year end.

Currently, global economic growth looks to be accelerating led by Europe, Japan and the U.S. Therefore, the economic backdrop remains supportive of global equity markets. Historically, when the economy is expanding any equity market pullbacks tend to be shallower and shorter lived than those associated with recessions. At least for now there are no signs of recession either in the U.S. or globally. Further, our intermediate and longer-term equity market indicators remain positive and suggest that this should be a normal seasonal pull back within a longer-term uptrend.

As you know, we have already taken profits in some extended positions and raised a cash cushion. This cash will allow us to take advantage of opportunities that this seasonally weak period typically creates. Our expectations are that we will be able to re-deploy this cash over the next few months to take advantage of the seasonally strong year-end.

Of course, should market conditions deteriorate we would move quickly to raise additional cash and protect portfolios. However, the longer-term trend for the market continues to remain bullish at this point.

Please do not hesitate to call us if you have any questions. We hope you enjoy the last few weeks of summer.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Riggs), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Riggs is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Riggs’s current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Riggs client, please remember to contact Riggs, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.