The Riggs’ Investment Team manages investments with the belief that if you navigate well through high risk markets, the upside will take care of itself. So how does Riggs manage risk in the investment markets? First, we identify and pay for the best independent research sources we can find. From those sources, we get tremendous data—from current market momentum and strength indicators to historical similarities to previous markets to global economic data. Next, we use the perspective of our in-house team who has managed money in the investment markets in every decade since the 1960s. We stack up all of the external and internal evidence to paint a picture of the investment landscape. If the evidence builds a case for a strong possibility of a market pullback or a market rally, we don’t fight it.

As we entered the fall, the case for a U.S. stock market pullback was building. Despite the fact the U.S. stock market was reaching all-time highs, momentum was slowing and optimistic investor sentiment was reaching levels not seen since prior to the crash of 1987. Further, the Federal Reserve indicated that they planned to stay the course and end a quantitative easing program on October 15th—a program that has pumped in excess of $1.7 Trillion into the U.S. economy since January, 2013. The economic growth in Europe and China was slowing, and, as a result, demand for commodities slowed. Finally, geopolitical risk in areas like the Ukraine, Syria, and Hong Kong had increased. Each of these issues individually may not make the case for a stock market pullback but, in combination, the case was compelling.

Thus, we made a tactical decision to increase the level of cash and fixed income holdings in your portfolio. By positioning the portfolios defensively in the short term, we are reducing the exposure to a market correction and preserving wealth. As risk levels decline and the market regains its forward momentum, we will put the cash back to work into sectors with strong growth. When we buy or sell a holding in your portfolio, it is a thoughtful, measured decision. Right now, we have positioned the portfolios defensively. Our expectation is that we may be back to the buy side before year end.

* * *

With that as our backdrop, let’s delve further into what we are seeing in the economy and the equity and fixed income markets.

The U.S. Takes the Training Wheels Off:

The Federal Reserve On Track to End Quantitative Easing on October 15th

As we enter the fourth quarter, the U.S. economy and the investment markets are becoming increasingly attuned to the Federal Reserve phasing out the quantitative easing program that began in 2013. Through their purchases of government debt, the Federal Reserve has pumped $1.7 Trillion into the U.S. economy in order to fuel economic growth. This program in combination with their policy to keep the short term interest rate at zero served as a boon to home buyers and auto buyers, provided stability to the fixed income market, and allowed corporations to refinance debt, make capital investments and initiate stock buy-back programs. As corporate growth returned so did growth in the U.S. stock market. This month, the Federal Reserve is removing one of the training wheels—the monthly purchase of U.S. Treasuries and mortgage-backed securities—a purchase program that has greased the wheels of the U.S. economy for years.

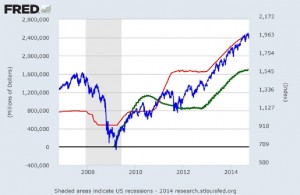

As this chart illustrates, there is a strong relationship between the growth in the stock market and the Federal Reserve’s quantitative easing programs. The red and green lines represent the purchase of Treasury and mortgage backed securities by the Federal Reserve. The blue line is the S&P 500. So the question unanswered is what happens when the training wheels come off and the economy must stand on its own? It is possible the investment markets may have priced in the end of the quantitative easing program, but no one will know for sure until we go through it.

As this chart illustrates, there is a strong relationship between the growth in the stock market and the Federal Reserve’s quantitative easing programs. The red and green lines represent the purchase of Treasury and mortgage backed securities by the Federal Reserve. The blue line is the S&P 500. So the question unanswered is what happens when the training wheels come off and the economy must stand on its own? It is possible the investment markets may have priced in the end of the quantitative easing program, but no one will know for sure until we go through it.

Over the last six years, the Federal Reserve has largely held captive the fixed income markets through its quantitative easing programs. During that time, the Federal Reserve has essentially been doubling down on their extraordinary measures of quantitative easing increasing purchases and keeping interest rates historically low. How will the bond markets react now that the Federal Reserve is stepping away from these programs? The answer to that question depends on the economy.

We enter the fourth quarter looking at a global economic environment that is diverging with many cross currents. While the U.S. economy is doing well, the global economy is slowing. The European Union is struggling with several economies in southern Europe in recession. France is on the verge of a recession and Germany’s economy has slowed to a crawl. The unemployment rate in Europe is stuck in the double digits with youth unemployment in southern Europe north of 30%. Europe appears to be on the verge of a crisis similar to 2011 and 2012.

China’s economy is in transition. Low end manufacturing fueled economic growth for years. Now the Chinese government is trying to drive economic growth through a consumer-driven style economy similar to the U.S. While other countries have successfully made this transition, they have done so over decades not years and through a natural transition as the economy matured. China is attempting to fast track this transition driving it from the top down as opposed to the natural evolution of the Chinese consumer. It would not surprise us to see some hiccups as the world’s second largest economy makes this transition.

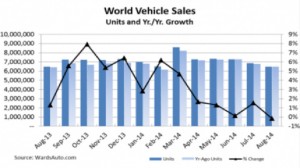

A slowdown in economic growth in Europe and China will certainly affect countries whose economic growth is fueled by exporting natural resources—areas such as South America and Africa or countries such as Australia. For example, this chart illustrates that the growth rate in automobile sales has dropped significantly in the past twelve months. If this trend continues, we could begin to see this slowdown affect the U.S. economy.

A slowdown in economic growth in Europe and China will certainly affect countries whose economic growth is fueled by exporting natural resources—areas such as South America and Africa or countries such as Australia. For example, this chart illustrates that the growth rate in automobile sales has dropped significantly in the past twelve months. If this trend continues, we could begin to see this slowdown affect the U.S. economy.

For now we recommend a conservative approach towards the fixed income markets. With the Federal Reserve’s bond purchase scheduled to end on October 15th and an expected increase to the short term interest rate in 2015, one would expect interest rates to generally move higher. However, if the slowdown in much of the global economy begins to affect the United States, we could see the Federal Reserve step in again with another extraordinary measure to prop up the U.S. economy.

With a muddled fixed income landscape, we are taking a defensive approach to that market. We continue to keep maturity schedules short. Should the Federal Reserve begin to raise short term interest rates and the market begins to normalize, our approach will provide us the flexibility to take advantage of a rising rate environment.

Our Indicators Tell Us the U.S. Stock Market Rally May Be Getting a Bit “Long in the Tooth”

As we discussed, we are seeing a slowdown in much of the global economy. The European Union is inching toward a possible economic crisis raising the sustainability of the Euro once again into question. Economic growth in China is slowing as it deals with trying to transition and modernize its economy. While the U.S. economy is strengthening, the end of each Federal Reserve quantitative easing program since 2009 has resulted in an equity market correction of some magnitude. So while the U.S. economy looks okay, there are some storm clouds forming on the horizon. In addition to the economic concerns, a number of our indicators are signaling the possibility of a market pullback.

As you know we have been concerned about valuation levels for some time. When we look at historical valuation ranges on things such as price to earnings and price to sales we see a market that is overvalued. While elevated valuations by themselves do not mean markets will correct, they are a useful tool in measuring risk.

Market Sentiment Indicator

When we look at market sentiment we utilize many different types of indicators—from how much cash mutual fund managers have to how leveraged investors are through margin debt to surveys of both professional and individual investors. Sentiment is only important when it reaches extreme levels as it tends to point to a market top or a market bottom. We have begun to notice sentiment nearing extreme levels. For example, according to Investors Intelligence the number of investors with a bearish or negative outlook towards the stock market was recently at its lowest level since January of 1987. People are usually most optimistic about the markets near market tops and most negative at market bottoms.

Breadth Indicator

We also look at are market breadth indicators. These indicators measure the internal health of the market–much in the same way your doctor measures your blood pressure and cholesterol to measure your health. We use our various breadth indicators to measure the trend, momentum, and relative strength of each sector, industry, and individual security that make up the major market indices. We then compare these components to the market itself. What we have seen over the last couple of months is that while the major indices have been hitting new highs, fewer and fewer sectors, industries and individual securities are participating in the up side move.

As you can see, our indicators are flashing a caution sign and the case is building for a market pullback. For that reason, we have been moving toward a more conservative stance in your equity portfolios. While nobody can predict with certainty what will happen over the next several weeks or months. What we do know is that on both a fundamental and technical basis the stock market is deteriorating and risk levels are elevated.

Summary

We are taking a proactive, tactical approach to protecting your wealth—not unlike what we did in 2001 and 2007. First, we have captured profits in holdings where we felt the stock price had moved far beyond the underlying fundamentals of the company. Next, we have harvested tax losses in holdings which were not moving in line with the market. Finally, we have moved these proceeds into short term treasury instruments as a protective measure. These strategies ensure that we not only protect your wealth, but provide you with the liquidity you need to buy stocks when things go on sale. We work hard to make intelligent decisions and protect your wealth in an environment where risk is now elevated. As always, should you have any questions with regard to our investment strategy, please let us know.