U.S. equity market volatility increased in 2014 driven by slowing economies in Europe and Asia and an increase in regional conflicts in Eastern Europe and the Middle East. The U.S. markets served as the safe haven for investors where areas such as large cap equities and long term U.S. Government bonds benefited the most from the 2014 flight to safety.

As we turn to 2015, Europe is on the edge of deflation (risking a lost decade or worse), Asia continues to slow as China works to transform their economy from a low end manufacturing-based economy to one with greater technology and a larger consumer class, and the U.S. economy continues to plod along. All of this leads us to believe we could see more of a continuation of volatility in 2015 but with a stock market that continues to cycle higher. Thus, 2015 will be another of year of stepping carefully and avoiding the potholes. Let us take a look at some of the major factors which could affect the global economy in 2015.

U.S. Stock Market

Why do we believe that 2015 could be another volatile year for the U.S. stock market? The fixed income markets will be going through a transition period as the Federal Reserve moves toward normalization of short term interest rates. Transition periods for the fixed income markets always increase uncertainty in the stock market and that uncertainty leads to volatility. Additionally, the stock market remains overvalued, investor sentiment remains extraordinarily high, and the “shock absorber” of cash available on the side lines remains at historically low levels. All of these factors in combination will likely lead to a bumpy year in the U.S. equity markets.

The Riggs’ Report is written and published by Riggs Asset Management Company, Inc. The information contained in this Report is for informational purposes only and should not be construed as investment advice. All rights reserved.

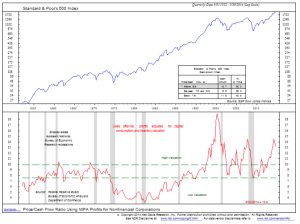

From a valuation perspective, the chart to the right shows that we have now reached the valuation peak that we saw in 2007 on a price to cash flow basis. Further, the median price to earnings ratio remains elevated at 21.2 as of the end of the year. The 50-year average of the median price to earnings ratio is 16.7 by these measures the market is extended by just over 20%.

From a valuation perspective, the chart to the right shows that we have now reached the valuation peak that we saw in 2007 on a price to cash flow basis. Further, the median price to earnings ratio remains elevated at 21.2 as of the end of the year. The 50-year average of the median price to earnings ratio is 16.7 by these measures the market is extended by just over 20%.

Another concern is the lack of investor cash on the side lines. As we have discussed before, cash acts like a shock absorber allowing investors to withstand market declines and take advantages of opportunities. As the chart illustrates, currently cash reserves are in line with levels that we saw in 1998, 1987 and 1979–all of which were difficult market periods. Perhaps one of the reasons that cash levels have remained so low is that the Federal Reserve has maintained a zero interest rate policy for the last several years. This policy has forced savers and investors alike out of money market funds. As the Federal Reserve moves toward normalization, we could see money flow out of other types of investments and back toward more traditional saving vehicles.

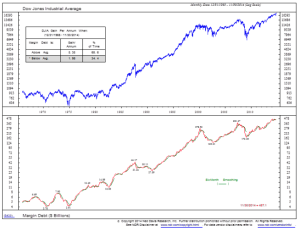

Finally, we continue to be concerned with the level of margin debt. Margin debt is the total amount owed to brokerage firms by customers who have borrowed money to purchase securities. These loans are collateralized by the securities purchased. Margin debt is primarily utilized by speculators, hedge funds, traders, and other institutions and an increase in margin debt can be bullish for the stock market as it provides more money to the markets for purchasing securities.

Finally, we continue to be concerned with the level of margin debt. Margin debt is the total amount owed to brokerage firms by customers who have borrowed money to purchase securities. These loans are collateralized by the securities purchased. Margin debt is primarily utilized by speculators, hedge funds, traders, and other institutions and an increase in margin debt can be bullish for the stock market as it provides more money to the markets for purchasing securities.

However at extremes margin debt can create real problems. If there is a market correction, speculators are forced to sell their holdings to cover their margin. This will tend to exacerbate moves to the downside. Margin debt is now above levels seen in both the 2000 and 2007 market tops.

All of the above indicators signal that investor sentiment is extremely bullish and that the stock market may be stretched. In the short to intermediate time frame, we are overdue for a market correction. On a longer term perspective, we believe we have entered a long term bull market not unlike what we saw from 1944 to 1966 or 1982 to 2000. So while we have short term concerns for the equity markets, our long view is that the next decade should provide many opportunities for equity investors.

There are three areas that are likely to have the greatest influence in 2015—1) How Europe manages through their economic challenges; 2) the impact of low oil prices on the U.S. economy; and 2) how skillfully the Federal Reserve begins the normalization process for short term interest rates.

Europe is facing many headwinds today—from an aging workforce in Northern Europe, to double digit unemployment throughout Southern Europe, and, most important in the short term, the inability of European leaders to solve their credit crisis that is now entering its eighth year. Sitting at the heart of each of these issues is the Euro.

Prior to the creation of the Euro, many of the financial problems facing Europe today would have been solved on a country by country basis, where differences in economic approaches would have been resolved through the currency markets. In a highly simplified example: stronger economies like Germany would have a strong currency while weaker economies such as Italy would have weaker currency. As a result, Italian goods would be relatively cheaper than German goods which in turn would provide support for the Italian economy. This would mean more jobs in Italy which over time would also increase demand for German goods, as people working in Italy could afford to buy more of both Italian and German goods. Under the euro, this self-correcting mechanism is eliminated. In theory, the solution to these problems is simple; if you are going to have a common currency you also need common rules, regulations, social pact with your citizens, and common fiscal policies. In reality though, you have political issues that speak directly to the sovereignty of each country.

The economic crisis is now moving from the streets to the capitals as political groups once considered “fringe” gain political power. In Southern Europe, we are seeing political parties on the far left rise in power and in Northern Europe we are seeing political parties on the far right rise in power. The upcoming election in Greece on January 25th currently favor the Syriza—a far left party that favors a default on Greek debt and/or a Greek exit from the Euro. If the Syriza party wins it could mark the beginning of a larger European fracture where more extremist national parties in one country give rise to more extremist national parties in another country. If this continues, then we could see the ongoing economic crises turn into a full blown political crisis. The Euro was originally a French concept with a thought to bind the European heartland together so tightly economically that another European war would be impossible. As more nationalist parties rise to power, that concept may be placed under pressure.

The European economy will likely remain in the doldrums and represent a drag on the global economy. While the European central bank is promising a U.S.-style form of Quantitative Easing Program, there are significant structural differences between Europe and the U.S. that will likely make Europe’s eventual attempt less successful. As the issues facing Europe begin to express themselves in the political arena, we could see European-driven volatility occur in the U.S. markets similar to what we saw in 2011 and 2012.

The effect of this for U.S. investors are threefold—1) if concerns rise in Europe, money will flow to U.S. Treasuries as a safe haven thus driving Treasuries yields even lower; 2) if volatility increases in the European Stock Exchanges, that volatility could flow to the US markets as well (just as it did in 2011 and 2012); and 3) we live in a connected world and the European Union is the largest economic entity in the world. As a result, economic challenges in Europe will hurt U.S. companies and the U.S. economy.

Energy and the U.S. Economy

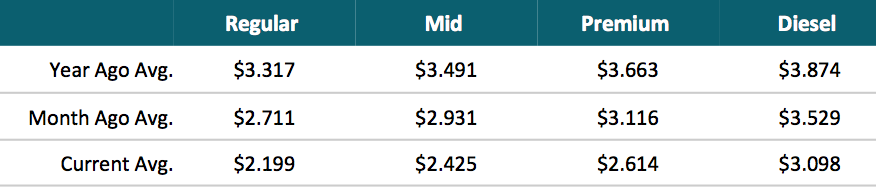

The second major macroeconomic theme in 2015 will be energy prices. While there has been a lot of press on how declining oil prices will benefit the U.S. economy, we actually see it as more of a mixed bag for 2015. Over the past year, the price at the pump has declined by roughly 30%. While this is good for U.S. consumers, the amount of disposable income actually spent at the gas pump has been declining for 30+ years. In 1980, the average family spent about 8% of their disposable income on energy. Today that figure is closer to 4%. We estimate that someone who fills up four times a month could save approximately $1,100 over the course of a year. Since this “savings” will be realized in small amounts, the large majority of it will not be saved but, spent in other ways and it will filter through the economy acting as a small stimulus to consumer spending.

Unfortunately, with the price of oil down to about $50 a barrel and with U.S. shale production costs estimated to run between $40 to $70 a barrel, many current and future shale projects will be delayed or canceled. This will have a ripple effect throughout the manufacturing and services base as companies that have grown over the past several years in support of the drilling industry see demand slow.

Further, the energy industry has been one of the few industries creating and supporting higher wage jobs over the past six years. According to Rigzone’s Salary Survey, in 2014 the average salary for a person working in the oil and gas industry was $90,000. That figure is well above the median household income of roughly $52,000. So, while declining oil prices will benefit many consumers, a slowdown in the U.S. energy sector will affect the number of high paying jobs and have a ripple effect on jobs in related and supporting industries.

The last time we saw a decline in energy prices of this magnitude was in 1980. At that point, the U.S. imported nearly twice as much of its energy needs than it does today. Further, households and industry consumed much more energy as a percentage of their incomes than they do today. Therefore, the positive benefits of lower energy prices on the U.S. economy will have a more muted effect than it did in the early 1980’s.

So while lower energy prices are a long term positive for the U.S. economy, in the short term it is much more of a mixed bag. Countries that will likely benefit the most from declining energy costs are countries like South Korea, China and India—all of which have a growing demand for energy and little internal production.

The Process of Normalizing Interest Rates

For the first time since 2008 we will not be talking about some form of Quantitative Easing by the Federal Reserve. In fact, the Federal Reserve hopes to gradually begin to “normalize” interest rates over the course of the next two years. What this means is to slowly raise short term interest rates to a point that they would be outside of the extraordinary actions by the Federal Reserve the past seven years. Over time, we could see an improvement in short term rates such as money market rates and CD rates which would benefit savers.

Along with this process of normalization the Federal Reserve plans to slow the reinvestment of principal in its bond portfolio. This process could start later this year. Since the financial crisis in 2008, the Federal Reserve has grown its bond holdings from around $900 Billion to approximately $4,446 Billion today. To normalize their balance sheet, the Federal Reserve would need to reduce their bond holdings by nearly three-quarters. Therefore, this process will be done very slowly so as not to disrupt the bond markets and it should take many years to bring the Federal Reserve’s bond holdings to normal levels.

Along with this process of normalization the Federal Reserve plans to slow the reinvestment of principal in its bond portfolio. This process could start later this year. Since the financial crisis in 2008, the Federal Reserve has grown its bond holdings from around $900 Billion to approximately $4,446 Billion today. To normalize their balance sheet, the Federal Reserve would need to reduce their bond holdings by nearly three-quarters. Therefore, this process will be done very slowly so as not to disrupt the bond markets and it should take many years to bring the Federal Reserve’s bond holdings to normal levels.

While the process of normalization will be done slowly and carefully, this will mark a new environment for the fixed income markets and fixed income investors. Further, this process will be dependent on the sustained improvement in the U.S. economy. If issues in Europe or the slowing economies in Asia begin to weight on U.S. economic growth, we could yet see Federal Reserve rethink their current approach.

For fixed income investors, we see a bond market that will likely stay in a range for 2015 where longer term treasuries will be driven by global events and most other fixed income categories such as Municipal Bonds, Corporate Bonds, Mortgage-backed and High Yield bonds will be driven by the U.S. economy and whether the Federal Reserve can successfully manage its way through this “Normalization Process.”

We continue to recommend a conservative approach for fixed income investors and recommend using high-quality corporate and municipal bonds. We would continue to avoid High Yield and International bonds at this time.

Summary

In summary, we believe that we could see volatility continue to increase in both the U.S. stock market and the U.S. bond market for 2015. This is likely to be a headline-driven year and we are monitoring events in Europe, in the Energy industry and the movements of the Federal Reserve to normalize rates and reduce its balance sheet. All of these challenges (as well as those that are not yet known) will litter our path with potholes this year. We will continue to manage your assets in a conservative manner to mitigate market risk and take advantage of a market that should continue to trend higher as the year progresses. On the bond side, investors should remain conservative in their approach as the transition to a rising rate environment may cause some volatility to the fixed income markets. In the long-term this process should lead to better opportunities for fixed income investors and savers.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs Asset Management Company, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/ she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.