As we discussed in our January Riggs Report, Volatility But Higher, we expected to see increased volatility in both the equity and fixed income markets in 2015. So far, the year is playing out as we expected. We have seen a slowdown in U.S. economic growth and in the earnings growth for U.S. companies. As a result, the S&P 500 and Dow Jones Industrial Average indices ended the quarter flat to down. The bond market has moved up and down in a narrow range as it is caught between the policy actions of the European Central Bank and the U.S. Federal Reserve. While it was a choppy quarter for the markets, the Riggs Investment Team concentrated investments in key growth sectors and companies which allowed your portfolios to finish the quarter strongly.

Slowing Growth Leads to a Bumpy Equity Market

With the first quarter behind us, what can we expect from the equity markets going forward? From a long-term perspective, we are very positive on the growth prospects of the U.S. equity market. We believe we are in a secular (long-term) bull market cycle in U.S. equities where the market is likely to move higher. However, within that long-term cycle there will be periods where the markets take a breather. Since markets are forward looking and they price in future expectations, on occasion it simply gets ahead itself or faces a new wrinkle that may not have been factored into the future expectations. We believe 2015 may be one of these periods.

One area of concern is the valuation levels of the market. Just like when looking at individual companies to see if the valuations make sense, we look at the markets and compare the price of the market to its earnings and sales. When the year began, Wall Street analysts were projecting the S&P 500’s 2015 growth in earnings to climb as high as 14%. Three months later, now analysts are projecting earnings for the year to be flat or even down in comparison to last year.

The Riggs’ Report is written and published by Riggs Asset Management Company, Inc. The information contained in this Report is for informational purposes only and should not be construed as investment advice. All rights reserved.

So how are we making money for Riggs’ clients in an environment of slowing growth? The stock market has a tendency to reward industries, sectors, and companies that can provide consistent growth in earnings and, more importantly, sales. For this reason, we transitioned your portfolios toward growth companies several years ago. We have focused new holdings in four key areas—1) Health Care; 2) Technology; 3) Consumer Staples; and 4) Consumer Discretionary. This transition has allowed our portfolios to continue to do well in a market with increased volatility.

Over the past several months, we have seen the markets narrow. While the uptrend remains intact, there are fewer and fewer companies participating to the upside. Where once you could be rewarded simply for buying the index, with a narrowing market you now must “shuck through the oysters to find the pearls.” While our indicators remain positive and show the uptrend intact, we will continue to focus our portfolios on companies that show strong growth in earnings and sales.

A Shift in U.S. Savings Could Signal More Growth Ahead

We may be seeing early stages of a new trend in the U.S. Savings Rate. Millennials having lived through the 2000 stock market bubble, the 2001 terrorist attack, and the 2008 financial crisis, seem to be approaching their personal financial health more cautiously than their Baby Boomer Parents. In fact, studies show that Millennials have a savings mentality similar to the Depression-Era babies. They are less trusting of large institutions, including the government, and they do not believe that Social Security will be a significant part of their retirement. They embrace technology and tend to have a financial plan and set specific goals for achieving their personal financial success.

While their parents, the Baby Boomers, as a group have vastly under-saved for their retirement and are now playing catch up. Many Boomers plan to work well into their seventies either because they can or because they must. As a result of under-saving, many Boomers are dependent on Social Security to supplement their retirement income.

The Millennials and the Baby Boomers are the two largest demographic cohorts in the United States—representing roughly 62% of the population. As a result, they will drive the economic, political and social future of this country. While their needs and desires may diverge in many areas based on age and their life stage, we could be seeing a convergence in their need or desire to save.

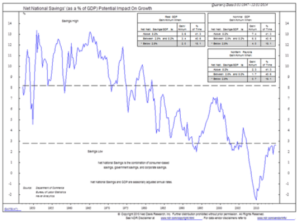

Are we seeing a gradual change in the spending and savings patterns in the U.S.? As the chart illustrates, Net National Savings (which is the combination of consumer-based savings, government savings, and corporate savings as a percentage of GDP) has been trending down since the mid 1960’s. Over the last several years, we have seen savings in the U.S. gradually improve. If this trend continues, it would bode well for future growth in the U.S. There is a strong positive correlation between high savings rates and new business formation. Spending on long lasting capital expenses such as new plants, infrastructure and communication systems leads to better GDP growth. Better GDP growth means more jobs and higher wages in the long run.

Are we seeing a gradual change in the spending and savings patterns in the U.S.? As the chart illustrates, Net National Savings (which is the combination of consumer-based savings, government savings, and corporate savings as a percentage of GDP) has been trending down since the mid 1960’s. Over the last several years, we have seen savings in the U.S. gradually improve. If this trend continues, it would bode well for future growth in the U.S. There is a strong positive correlation between high savings rates and new business formation. Spending on long lasting capital expenses such as new plants, infrastructure and communication systems leads to better GDP growth. Better GDP growth means more jobs and higher wages in the long run.

While a higher savings rate will slightly reduce current consumption and current economic growth, the long term benefits of having a wealthier more financially secure country are tremendous. We are very positive on the long-term growth prospects for the U.S. economy and a rising savings rate would be another long-term plus.

Your portfolios are doing well and while the near term may be a little bumpy we have entered a long term bull market and expect to continue to find good opportunities over the next decade or longer.

This is not your Grandparents’ Bond Market

The bond market is much different today than at any time in our history. It is more globally driven and far less liquid. Today, the U.S. bond market remains range bound and trapped between the policy actions of the European Central Bank (ECB) and the U.S. Federal Reserve. The ECB initiated its long discussed Quantitative Easing program this quarter—a program where individual countries within the Euro Zone print money to buy bonds from their country’s banks. The banks then must decide what to do with the extra cash on their balance sheets. Banks could use this cash to lend money to people and businesses or they could buy other bonds.

The European economy remains flat and there is little growth outside of Germany and a few Northern European neighbors. Southern Europe remains in a depression with the unemployment as high as 25% in some countries. Therefore, there is little to no demand for new loans. So, the European banks are taking large portions of the extra cash from quantitative easing and using it to buy U.S. government bonds. This is helping to keep demand for U.S. bonds high and yields low.

While the Europeans are initiating quantitative easing, the U.S. Federal Reserve is moving away from the extraordinary measures it has undertaken to support the economy and moving towards a more “normal” environment. This means slowly moving away from the zero interest rate policy and toward a more normal range–somewhere between 1% to 1 1⁄2% on short term yields. Currently 10-Year Treasuries yield just less than 2% and 30-year Treasuries yield just over 2 1⁄2%. It is likely that as the Federal Reserve moves to a more normal interest rate structure over the next few years, the pressure on the bond market will increase as the difference between short term rates and longer term rates is squeezed.

Many in the industry have expressed concern over the liquidity in the bond market. As you know, liquidity is the lifeblood of any well-functioning market. It allows investors to move in and out of positions without significantly moving the price of the securities they are buying and selling. Since 2008, buffeted by new regulations and scarred from their near-death experience big banks have quietly retreated from the business of holding large inventories of corporate bonds. At the same time, the amount of corporate bonds held on the balance sheets of dealer banks such as Goldman Sachs and JP Morgan have fallen 78% since their 2007 peak. This has reduced the amount of bond risk on banks’ balance sheets.

While banks are shrinking their bond inventories, investors are pouring in money—more than $525 Billion—into investment grade corporate bond funds hoping to find better yields at a time when interest rates are at record lows. The risk embedded in corporate bonds has now shifted from the banks to investors.

So if banks won’t step into the market as a primary buyer, what would happen to the bond market should an event occur that spurs investors to race for the exits? That is the question that causes us to remain cautious and vigilant toward the fixed income market.

Summary

Both the Stock Market and the Bond market have seen their day to day volatility rise and we believe we will most likely remain in a bumpy market environment for some time.

For the equity markets we remain concerned about valuations especially with earnings growth and economic growth stalling. The narrowing of the market also remains a concern. However, our market indicators remain positive and we are focusing our portfolios in areas and companies that can provide consistent returns in a slow growth economic environment.

For the fixed income markets we remain conservative until we see how the pull-push works out between the European Central Bank and the Federal Reserve. In addition, bond market liquidity continues to concern us.

As always we remain laser-focused to any change in the market environment and we will be proactive in our approach toward protecting your wealth and will take advantage of the opportunities in the investment markets.

IMPORTANT DISCLOSURES

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter, will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Riggs Asset Management Company, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/ she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.